SWIFT overview

The Power of Networking in SWIFT: Revolutionizing Financial Communication Globally

Welcome to The Engineer Banker, a weekly newsletter dedicated to organizing and delivering insightful technical content on the payments domain, making it easy for you to follow and learn at your own pace

Society for Worldwide Interbank Financial Telecommunication, commonly known as SWIFT, is a name synonymous with international financial messaging. While the entity is often associated with secure messaging, the crux of SWIFT’s impact lies in its networking capabilities. By seamlessly connecting financial institutions across the globe, SWIFT has revolutionized how money moves internationally. In this article, we explore the nuances of SWIFT’s networking capabilities and illustrate how they have become an integral part of the global financial ecosystem.

History

Founded in 1973, it was established by a coalition of 239 banks from 15 countries with the goal of creating a shared worldwide data processing and communications link, and a common language for international financial transactions. This vision was spurred by the realization that the then existing telex-based systems were fraught with inefficiencies and vulnerabilities.

SWIFT’s head office was established in Brussels, Belgium, and two operation centers were set up in the United States and the Netherlands. The organization’s modus operandi involved using a standardized approach to reliably exchange financial messages. In 1977, SWIFT revolutionized the financial industry by successfully reducing dependency on the telex for most FIN traffic and replacing it with a more secure and efficient messaging system.

As the years progressed, SWIFT broadened its range and volume of message traffic and services. It evolved from a messaging platform to an encompassing suite of products, services, and standards that facilitates secure and seamless financial transactions and communications globally. Today, SWIFT links more than 11,000 financial institutions in over 200 countries and territories, making it a cornerstone of the global financial infrastructure

SWIFTNet

The intricate architecture of SWIFTNet is predicated on a centralized store-and-forward mechanism. Member institutions send messages to the SWIFTNet system, which then routes them to the intended recipients. This not only ensures the reliability and traceability of the communications but also adheres to the stringent security protocols necessary for sensitive financial data. Furthermore, SWIFT messages conform to a structured format, allowing for consistent and efficient communication across varied systems. For instance, the MT103 message type is used to execute single customer credit transfers globally, while the MT202 message is utilized for interbank transfers.

SWIFTNet encompasses an array of participants and stakeholders. The primary parties involved are the member financial institutions, which include banks, brokerage houses, asset managers, and other non-banking entities that require secure financial communications. Moreover, central banks and market infrastructures such as stock exchanges and clearinghouses are also crucial constituents of the SWIFTNet ecosystem. SWIFT itself is governed by a Board of Directors elected by the member institutions, ensuring that the evolution of SWIFTNet remains aligned with the industry's requirements.

SWIFTNet is an essential backbone of the international financial infrastructure, facilitating reliable, secure, and standardized communication between financial institutions. Through its rigorously structured message formats and resilient network architecture, SWIFTNet underpins a plethora of financial activities ranging from cross-border payments to securities settlements. As global finance continues to evolve, SWIFTNet’s role remains central in connecting and securing the world’s financial traffic.

Common Use Cases in global financial transactions

One basic use case of SWIFT is facilitating international money transfers between banks. When an individual or corporation needs to send money across borders, SWIFT codes are employed to identify the banks involved, ensuring that the funds are routed and credited accurately. Another use case is trade finance. SWIFT plays an instrumental role in streamlining trade finance by providing a reliable channel for the exchange of letters of credit, guarantees, and other financial instruments, which are indispensable in international trade transactions. It ensures that traders can execute deals with the confidence that financial instruments will be honored. Furthermore, SWIFT is used for securities trading. Investment firms and asset managers leverage SWIFT's network to buy or sell securities such as stocks and bonds on international markets. It enables swift and secure communication between parties and exchanges, which is critical for timely execution and settlement of trades. Moreover, corporations utilize SWIFT not only for making payments but also for obtaining account statements and managing cash positions across different banks and countries through a single, standardized channel. This consolidation and standardization are invaluable for treasury functions in multinational corporations, enabling them to optimize liquidity management and internal fund transfers. Through these use cases, SWIFT proves to be an indispensable backbone for global financial communications and transactions.

At its core, SWIFT is a vast network comprising over 11,000 financial institutions in more than 200 countries. These financial institutions include banks, asset managers, brokers, and even corporate businesses. The strength of SWIFT lies in its ability to connect these diverse entities through a standardized platform for exchanging financial messages, thus enabling seamless cross-border transactions.

One of the pivotal aspects that underpin SWIFT’s networking prowess is standardization. SWIFT has developed a set of message types and formats – known as MT messages – which standardize the information that financial institutions need to share. This harmonization ensures that despite geographic differences, all parties speak a common language, streamlining the communication process.

For instance, an MT103 message is used to execute a standard wire transfer, ensuring that institutions in, say, Brazil and Japan, are aligned on the information required for the transaction.

For a network of this scale to function efficiently, security and reliability are paramount. SWIFT employs state-of-the-art encryption, authentication, and verification technologies to ensure that messages are securely transmitted. Additionally, its resilient architecture and comprehensive disaster recovery procedures ensure that the network remains operational under all circumstances, a crucial requirement for global financial stability.

Let’s jump into a practical example. Imagine a company in India procuring machinery from Germany. The Indian company’s bank needs to communicate with the German supplier’s bank to execute the transaction. Here, SWIFT acts as the networking medium. The Indian bank sends a Letter of Credit (LC) via SWIFT to the German bank. This LC guarantees that payment will be made once the terms of the agreement are fulfilled. Both banks communicate through the secure SWIFT network using standardized message formats, ensuring the efficient execution of the trade transaction.

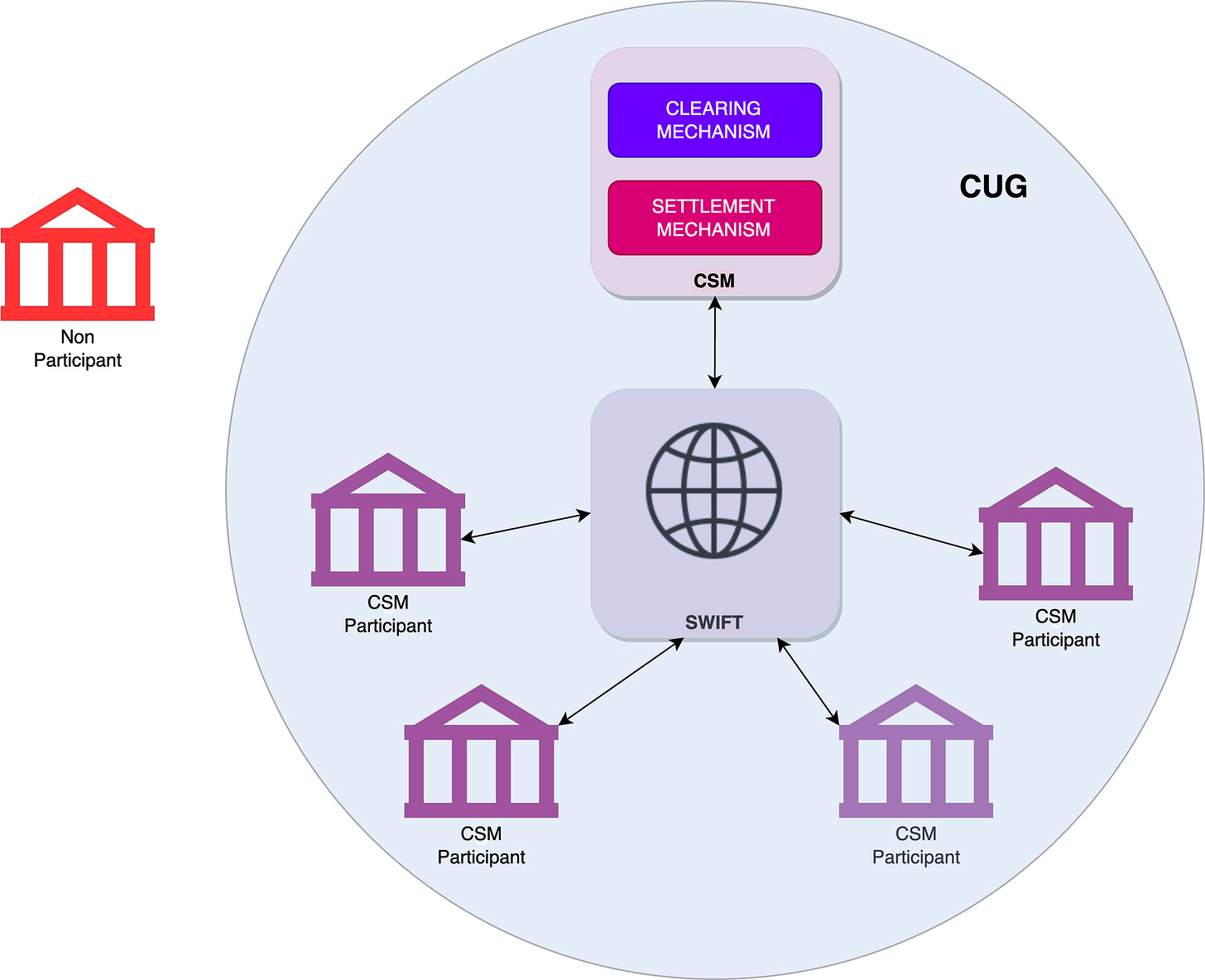

Closed User Groups

A SWIFT Closed User Group (CUG) is a sophisticated assembly of financial institutions that are bound by a specialized set of agreements, permitting them to communicate and transact within a controlled, secure, and highly customized environment on the SWIFT network. In essence, a CUG acts as a walled garden within the extensive ecosystem of the SWIFT network, wherein the members have a unique set of communication protocols, message formats, and transaction standards.

One of the most salient purposes of a CUG is to address the niche messaging or transactional needs of its constituent members, thereby providing them with a refined and customized experience. Let's delve into an example: consider a scenario where a group of banks and corporate entities are engaged in cross-border trade finance. These entities might form a CUG to facilitate the streamlined exchange of documents such as letters of credit and bills of lading. Within this CUG, the members could develop and implement bespoke message formats and validation rules specifically suited to the idiosyncrasies and complex necessities of trade finance transactions. This ensures that communication and transaction execution within this select community remain streamlined, secure, and compliant with the specific regulatory frameworks that govern trade finance.

Another illustrative example is the realm of securities transactions. A CUG may be formed by a collection of banks, asset managers, and securities settlement systems. The members of this CUG can construct tailored message formats and processing guidelines for the efficient exchange and processing of securities trade confirmations, settlement instructions, and reconciliation information. This specialized arrangement is indispensable for ensuring that the settlement of securities transactions is conducted with precision, efficiency, and in compliance with the myriad of regulations that govern the securities industry.

Furthermore, CUGs are not just constrained to financial transactions. They can be leveraged for administrative communication, reporting, and data exchange among the members. For instance, a CUG may be established by regulatory bodies and financial institutions for the submission of regulatory reports and compliance data.

By creating this specialized sub-network, CUGs enable members to harness the global reach and security of the SWIFT network while simultaneously tailoring the environment to meet specific industry or transactional needs. This blend of customization within a secure framework makes Closed User Groups an invaluable tool for financial institutions that require specialized communication and transaction processing capabilities.

SWIFT gpi: Next generation networking

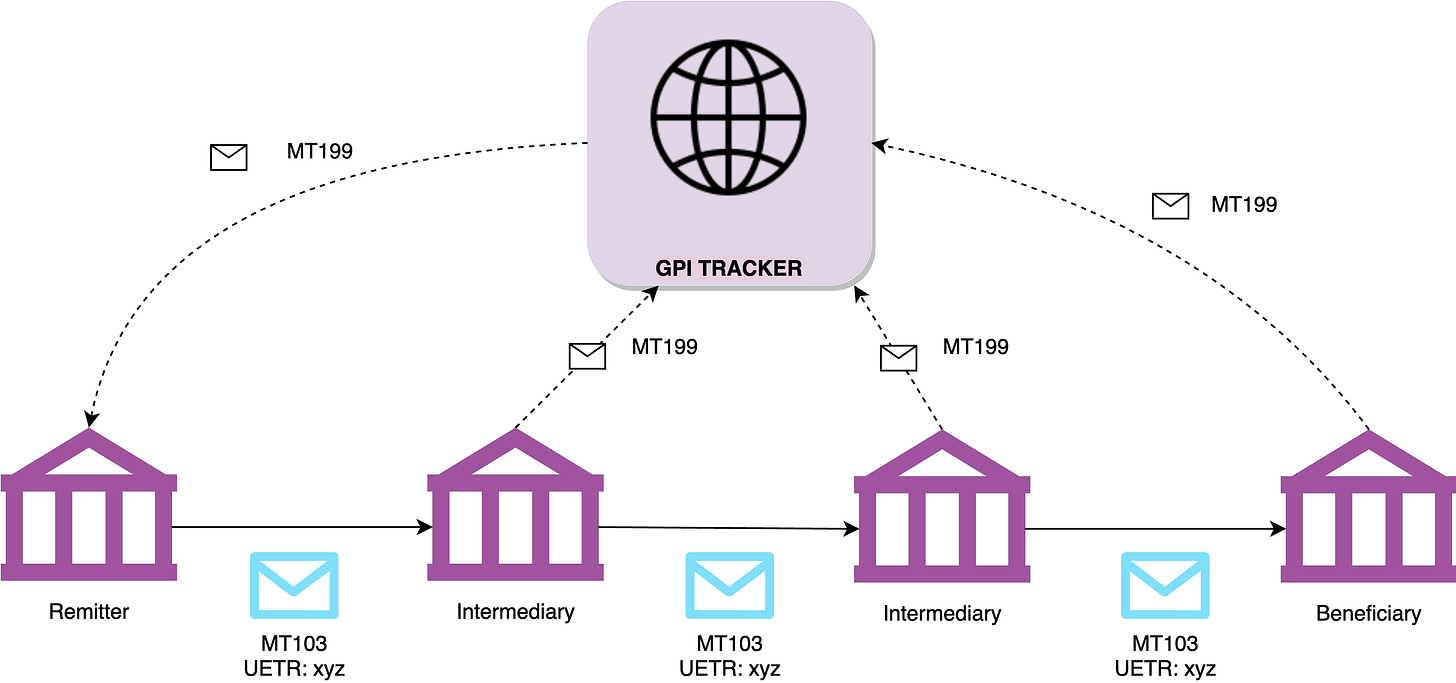

Recognizing the evolving needs of the financial industry, SWIFT introduced Global Payments Innovation (gpi). SWIFT gpi enhances the networking capabilities by facilitating faster, more transparent, and traceable cross-border payments. Through gpi, banks can track their payment messages end-to-end in real-time. For example, a non-profit in the United States receiving donations from Europe can monitor the status of the transfer in real-time, ensuring that funds are swiftly available for their initiatives.

In November 2017, SWIFT unveiled the Global Payment Innovation (gpi), aimed at enhancing and expediting cross-border payments, and has been progressively broadening its scope thereafter. To bolster the traceability of payments, gpi introduced the Unique End-to-End Transaction Reference (UETR), which serves as an integral component in facilitating automated tracking throughout the transaction lifecycle. As of November 2019, the implementation of UETR became obligatory for all banking institutions, inclusive of those that had not engaged in the gpi prior to this mandate.

Commencing November 2020, it became imperative for confirmations to be provided for transactions utilizing the MT103 format (Single Customer Credit Transfer) within the SWIFT gpi tracker. This modification has ramifications for all FIN participants. Consequently, any banking institution that wishes to receive payments in MT103 format is obligated to acknowledge them by dispatching an MT199 message (Free Format Message) to the SWIFT gpi tracker, confirming the allocation of funds to the respective customer’s account.

ISO 20022 Migration

ISO 20022 migration is a global initiative, which aims to achieve harmonized standards for the exchange of high-value payment messages. ISO 20022 is a messaging standard that creates a common language for payment data across the globe, enabling faster processing and improved reconciliation. SWIFT will introduce ISO 20022 for Financial Institutions in March 2023 for cross border payments and reporting (CBPR+). For Market Infrastructures, like Target2 in Europe, migration to ISO 20022 is set to be introduced as part of their modernization programs.

The SWIFT ISO 20022 migration represents a momentous evolution in the standardization of global financial messaging. ISO 20022 is an international messaging standard developed by the International Organization for Standardization, which enables richer, structured, and more versatile data exchange compared to the traditional SWIFT MT messages. The migration to ISO 20022 by SWIFT is being implemented in a phased manner, with the initial timeline set for November 2021 for cross-border payments and cash reporting. However, due to the global circumstances and the complexity of the transition, SWIFT has extended the migration window and is adopting a coexistence approach, where both MT and ISO 20022 messages will be supported for a period of time, expected to culminate in 2025.

Swift will introduce ISO 20022 as of March 2023. As of that date, Financial Institutions will have to be able to receive ISO 20022 payment messages. As of November 2025, all messages, both sending and receiving must be based on ISO 20022. During the co-existing period, from March 2023 until November 2025, Financial Institutions are still allowed to send current MT messages. This period is meant for FI’s to be able to gradually adapt to the new ISO20022 standards. The adaptation of ISO 20022 in market infrastructures differs per country/currency

The transition to ISO 20022 heralds several enhancements over the legacy MT message formats. ISO 20022 messages are constructed using a modular approach and can carry extensive data, offering financial institutions the ability to include more detailed and structured information. This facilitates improved compliance, risk management, and straight-through processing (STP) rates, significantly bolstering operational efficiencies.

Additionally, the migration to ISO 20022 fosters harmonization in global financial communications, as the standard is widely adopted across various market infrastructures and initiatives, including the Single Euro Payments Area (SEPA) and TARGET2. This widespread adoption culminates in a more integrated global financial ecosystem, optimizing interoperability and driving innovation. In essence, SWIFT's migration to ISO 20022 marks a paradigm shift in financial messaging, paving the way for more streamlined, data-rich, and harmonized communication in the financial sector.

In conclusion, SWIFT’s networking capabilities have been instrumental in shaping the global financial landscape. By connecting a myriad of financial institutions through a secure and standardized messaging system, SWIFT has streamlined cross-border transactions. Its ongoing innovations and adaptations, such as SWIFT gpi, underscore its commitment to remaining at the forefront of financial communication networks. As we navigate an increasingly globalized and technology-driven world, the role of robust, secure, and efficient financial networks like SWIFT remains more critical than ever.