ACH and CSM

Learn about payments systems building blocks

Greetings, fellow payment enthusiasts!

To kickstart the newsletter, our primary objective is to establish a solid foundation for readers who may not be familiar with the popular industry acronyms and concepts. By gaining mastery over these fundamental principles, you will navigate specialized articles, rulebooks, and news releases with enhanced comprehension and confidence. Our aim is to empower you with the knowledge needed to delve deeper into the intricate workings of the industry, unlocking new levels of insight and expertise along the way.

As we continue to experience technological advancements in the payments industry, understanding the difference between ACH and CSM has become fundamental. Both systems are used for clearing and settling transactions, but they operate differently. ACH: Automated Clearing House is an acronym that defines a system that handles large volumes of lower-value transactions, such as direct debits and credit orders. ACH is the software evolution of the clearing house process that has been in place for over a century. On the other hand, CSM: Clearing and Settlement Mechanism is a broader term that refers to any system used for clearing and settling transactions. Unlike ACH, CSM is not limited to handling low-value transactions and can be used for securities clearing, foreign exchange trading, and other high-value.

An ACH usually requires a connection to a settlement infrastructure, owned by the central bank of a particular region, to settle bulks and payment files while an integrated CSM typically includes settlement functionality within the system. Furthermore, the difference in cost between ACH and CSM is significant. According to various studies, the estimated marginal costs for ACH have decreased by up to 81% due to technical advances in computers and the deregulation of banking. However, the cost of using CSM is generally higher and varies depending on the value and volume of transactions being processed.

Let's take a closer look at how an ACH processes transactions:

Once a customer initiates a transaction, the bank sends the instruction to an ACH infrastructure within the submission window. This window is typically open for a limited time and can vary between banks and ACHs therefore the bank may hold the customer's pay-out until the new submission window is open on the next working day. The submission window intervals are aligned with the central bank opening days and hours. During each of these windows, the clearer infrastructure validates the payment structure and data and sorts transactions into batches based on payment types: regular transactions, R-transactions, standing orders, direct debits and so on. Some clearers offer priority queuing segmentation capabilities based on payment importance, value and other parameters. This mechanism enables banks to prioritize and optimize the processing of their transactions. In upcoming articles, we will delve into the intricacies of how banks establish secure connections with these essential infrastructures, providing a comprehensive understanding of the underlying connections.

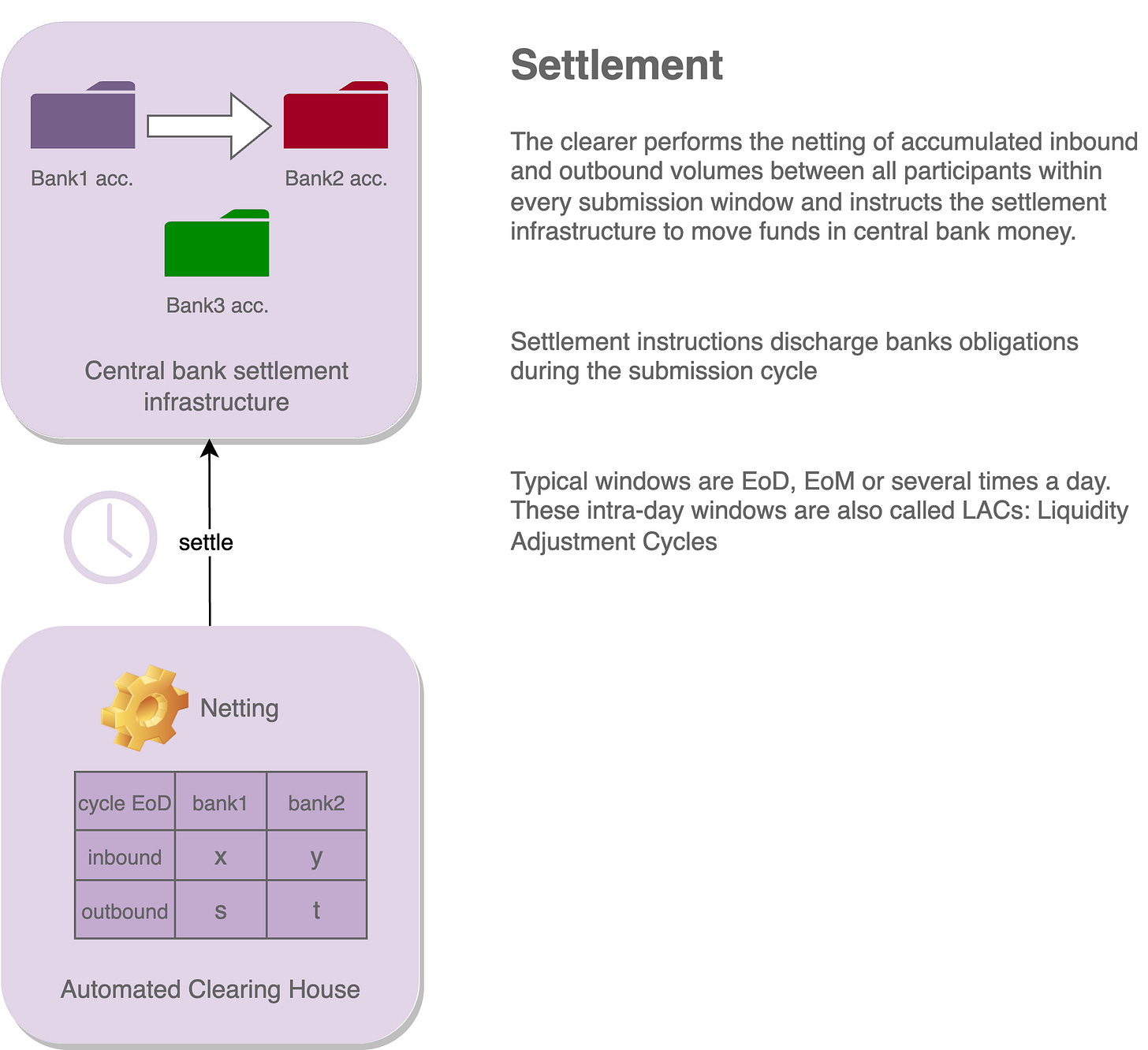

Once the batches are sorted and the submission window draws to a close, the ACH's netting process occurs. This involves offsetting the debits and credits within each batch to reduce the total amount of funds that need to be transferred. This means that all the transactions going in and out of a particular bank are added together, and the net balance is calculated. This reduces the number of transactions that need to be settled, ultimately saving time and money for participating banks. Interbank obligations within those batches in and out are then calculated and sent to the central bank, which handles settlement between banks in central bank money where funds are transferred from one account to another through a settlement infrastructure. In contrast, CSM distinguishes itself by incorporating a settlement process within its very own system, eliminating the necessity for external settlement infrastructure.

Once the settlement is finished and interbank obligations have been reconciled, outbound bulks are generated and sent to the beneficiary banks. At this stage, banks receive the bulk files as admission bulks, meticulously parse transactions within them, and thoroughly screen each incoming transaction as a crucial part of their risk management and fraud prevention efforts, ensuring that the transactions are legitimate and comply with regulatory requirements and finally seamlessly credit the customers' accounts with the funds.

In the case of a CSM the clearing and the settlement happen together within the same system as you can see in the previous diagram, such type of settlement is called RTGS: Realtime Gross Settlement as opposed to DNS: Deferred Net Settlement settlement. In an upcoming article, we will explore the funding models for RTGS and DNS settlement processes in further detail. Additionally, we will delve into the differences between these two settlement processes and how they impact participating financial institutions and we will also explore various participation models financial institutions can choose from. If you are interested in learning more about these important financial processes subscribe to receive our newsletter for regular updates.