Liquidity management in RT1

Strategies for Real-Time Treasury Operations

Welcome to The Engineer Banker, a weekly newsletter dedicated to organizing and delivering insightful technical content on the payments domain, making it easy for you to follow and learn at your own pace.

Welcome to the latest installment of Payment Bites! This week, we delve into the intricacies of liquidity management with a comprehensive new diagram focused on the RT1 platform.

Imagine the RT1 system as the powerful engine that drives real-time payments across Europe, efficiently processing and settling transactions. Just as an engine relies on gasoline to run smoothly, RT1 depends on adequate liquidity to function optimally. Liquidity serves as the fuel that ensures the continuous, seamless execution of transactions. Without sufficient liquidity, the robust infrastructure that RT1 provides would be akin to a high-performance engine running on fumes, unable to fulfill its potential.

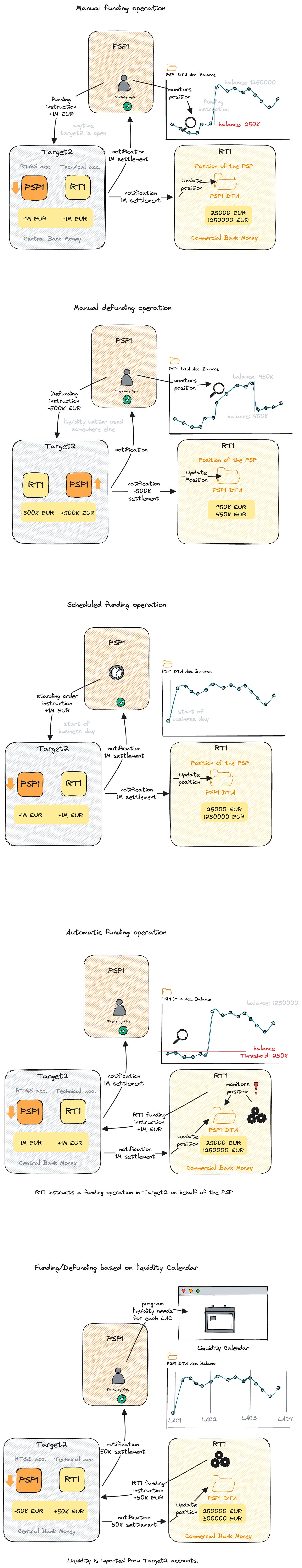

To ensure uninterrupted payment settlement, treasury teams must expertly manage liquidity, a process that generally entails three key actions: monitoring, funding, and defunding. Vigilant monitoring allows for real-time visibility into liquidity levels, enabling timely decisions. Funding involves injecting additional liquidity into the system to meet transactional demands, while defunding is the strategic withdrawal of excess liquidity. Together, these actions create a well-balanced liquidity framework that underpins seamless payment settlement.

Today, we are exploring diverse strategies that treasury operations teams can employ to manage liquidity within the RT1 system—insights that are readily applicable to general real-time infrastructures as well.