Introduction to FedNow

A Game Changer in the US Real-Time Payment Landscape

Welcome to The Engineer Banker, a weekly newsletter dedicated to organizing and delivering insightful technical content on the payments domain, making it easy for you to follow and learn at your own pace

We're about to embark on an exciting expedition, the first in a series of articles where we'll delve deep into the fascinating world of real-time payment systems and infrastructures. Throughout this journey, we'll highlight the commonalities that unite these systems and simultaneously shed light on the distinctive elements that make each one unique. We will cover from the mesmerizing web of the SEPA Instant infrastructures, RT1 and TIPS, that connects Europe like never before, to the thrilling new frontiers of FedNow and The Clearing House's RTP system in the United States, we'll traverse continents to bring you the most comprehensive guide on the revolution sweeping the world of payments. This is more than just an exploration; it's a celebration of innovation that's shaping our financial futures.

The first piece of the series will be devoted to FedNow, coinciding with its recent public release last Thursday, and how the design of this system can be seen as an evolution of Europe’s RT1 and TIPS. In anticipation of the next articles, we find it prudent to equip you with a comprehensive and understanding of real-time systems in a broader context. Armed with this broader perspective, you will undoubtedly appreciate the significance of FedNow and RTP as a pioneering real-time infrastructure, poised to shape the future of instantaneous and frictionless payments in the United States.

So tighten your seat belts and prepare for takeoff, as we launch our brand-new series Real-Time Payments: Connecting the World, Instantly.

Landscape in the US

The payments landscape in the United States is a fascinating tapestry of diversity, characterized by a mix of longstanding, traditional payment systems and innovative, digital-based platforms. The cornerstone of the US payment infrastructure is the Automated Clearing House (ACH) Network, which facilitates both domestic and international transactions such as payroll, direct deposit, tax refunds, and other large volume, low-value transactions.

At the other end of the spectrum, there's the realm of digital payments, which includes payment platforms like PayPal and Venmo, as well as mobile wallet services like Apple Pay and Google Pay. These platforms have revolutionized consumer behavior, making transactions quick, seamless, and increasingly cashless.

The landscape is also defined by card-based transactions, with Visa and Mastercard networks dominating the space. Credit and debit cards remain widely popular for in-store and online purchases alike. And let's not overlook the significance of check payments, which, despite the digital revolution, still play a substantial role in the US payment ecosystem, particularly in B2B transactions.

In recent years, real-time payment systems have also gained traction, with systems like The Clearing House’s Real Time Payments (RTP) network and the FedNow service from the Federal Reserve, promising instantaneous transactions. Zelle, a peer-to-peer payment service, has also risen in popularity for its real-time transfer capabilities.

The United States, a global financial powerhouse, is not far behind in the race of real-time payments. The Federal Reserve's system, known as FedNow, is poised to bring about a significant shift in the nation's payment landscape. FedNow aims to provide instantaneous payment services to all banks in the United States, thereby benefiting consumers, businesses, and government entities alike. Unlike the traditional batch processing systems that settle payments only during specific hours, FedNow will be a 24/7/365 service enabling transfers to be made and received at any time. The infrastructure will promote round-the-clock money movement, fostering increased efficiency and versatility in managing finances. FedNow bears similarities with certain existing payment systems. It operates as an interbank system, akin to both the ACH and Fedwire. Furthermore, similar to Fedwire but unlike the ACH, FedNow will function as a Real-Time Gross Settlement (RTGS) system, enabling immediate transfer of funds.

Meanwhile, FedNow's closest rival in the US, the RTP Network, launched by The Clearing House (TCH), has been operational since 2017. However, one significant difference between the two is their reach. While the RTP Network primarily caters to large financial institutions, FedNow aims to provide universal access to financial institutions of all sizes across the US, thus democratizing realtime in the country.

The situation in Europe mirrors that of the US with two competing real-time payment systems - RT1, owned by EBA Clearing, and TIPS, operated by the Eurosystem.

EBA CLEARING was initiated by the Euro Banking Association (EBA), an industry forum for the European payments industry with close to 200 member banks and organizations from across the EU. TIPS, or TARGET Instant Payment Settlement, on the other hand, is owned and operated by European Central Bank (ECB) and the national central banks of the Eurozone countries.

However, while the prospects of FedNow appear promising, there are potential downsides to consider. The integration of FedNow into existing banking systems may require significant time and resources, leading to higher short-term costs for financial institutions. Also, being a new system, it will have to undergo rigorous testing to ensure it can handle high volumes of transactions reliably.

Another concern is that although FedNow will enhance payment speed, the risk of fraudulent transactions could increase due to the lack of a 'cooling-off' period that comes with the delayed settlement of traditional payment methods. However, it's expected that security will be a top priority in the development of the FedNow service, leveraging advanced fraud detection systems to mitigate these risks. Comparatively, the existing Zelle network, a P2P payment system owned by several US banks, provides near-instant payment but only for those banks participating in the network. FedNow will be universally accessible by all banks, leveling the playing field for smaller institutions.

ISO20022 Realtime infrastructures

These infrastructures encompass payment systems operating under ISO20022 real-time message orchestration. While ISO20022 is a vast standard, implementations may differ in the messages used, but common principles unite all these systems.

At its core, the essence of all real-time infrastructures is to harmonize and streamline transaction processing, ensuring seamless coordination between the parties involved in a transaction to sync the distributed state between the originator bank books, beneficiary bank books and central infrastructure books. This synchronization is achieved through the effective utilization of ISO20022 messages. These real-time infrastructures aim to settle transactions within remarkably short timeframes, typically under 10 or 20 seconds, depending on the specific implementation.

Customer Credit Transfer

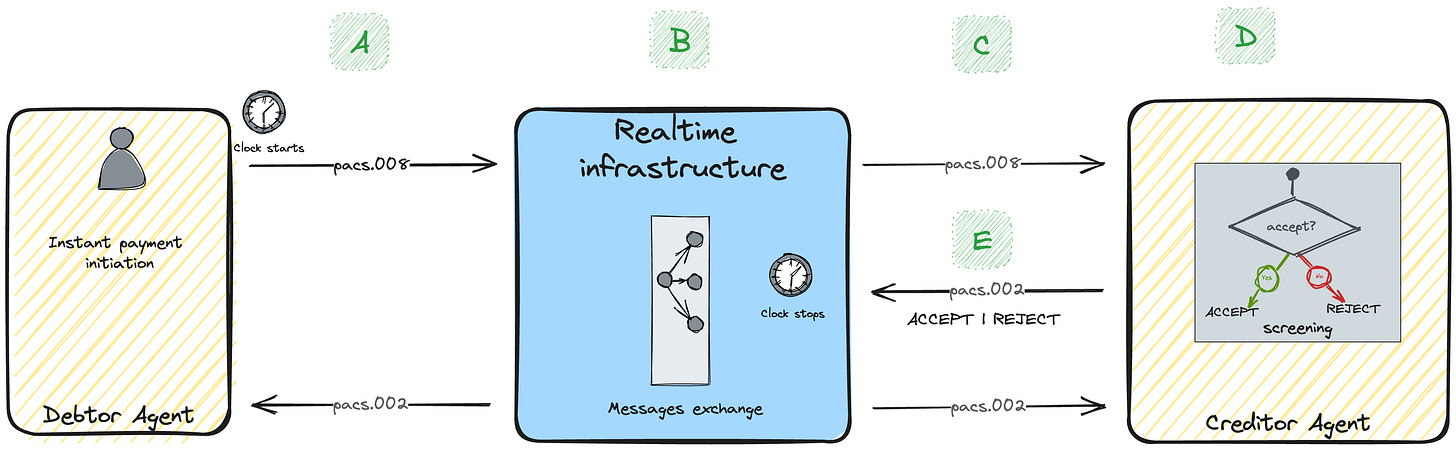

Let's take a closer look at one of the most crucial flows facilitated by these systems: the customer credit transfer. The most essential steps to remember about this flow are encapsulated in the following diagram. Within this visual representation, we can see the fundamental message exchange that takes place during a basic credit transfer between a debtor and a creditor.

The payment is initiated, and the debtor's account balance is temporarily held for the payout amount. The amount is reserved for the transaction end to end and the transaction with all payment details is sent to the payment scheme via a pacs.008 message.

The payment is routed to the correct destination using the beneficiary BIC or RTN contained in the payment message. The central system then awaits a response from the beneficiary side, allowing a few seconds for the receiving institution to acknowledge the transaction. The receiving institution screens the transaction and promptly provides a response within the specified time frame. Both FedNow and RTP offer the "accept without posting" option to the creditor institution, which is not available in RT1 and TIPS.

In case of acceptance the transaction is settled in the master accounts of debtor and creditor institutions. If rejected the amount reserved is released from the originator institution account.

At this stage the transaction is settled, participants must sync their state accordingly, therefore the central infrastructure sends a settlement notification so that books can be synced on both sides. Creditor side clears the pay-in and posts the transaction to the end beneficiary. Debtor side confirms the outbound transaction and commits the hold. In case of rejections the debtor side must rollback the state accordingly and remove the hold on the customer’s balance.

Below, you can see the customer credit transfer end to end and how it is affected by the clock. It commences when the debtor agent triggers the flow by sending the pacs.008 to the interbank space, inserting the timestamp in the message and activating the timeout clock of the transaction. Throughout each stage of the process, from message receipt to processing, and ultimately to receiving the pacs.002 in response, the infrastructure diligently adheres to the 10 or 20 seconds Service Level Agreement (SLA).

The 10-second timeout covers the entire roundtrip from A to point E. Delay in the process is introduced at every step of the roundtrip, therefore it is of extreme importance that the creditor agent takes the screening decision within few seconds.

A + B + C + D + E < 20 or 10 seconds depending on implementationIn the event that the timeout setting is surpassed, the pacs.008 is promptly discarded and rejected by the system, ensuring swift and efficient transaction processing.

It is essential to note that the settlement of the transaction, upon receiving the confirmation from the beneficiary bank, and the final notification to both parties are not subject to the timeout SLA, this crucial steps lies outside the scope of the SLA. In upcoming articles, we will explore how FedNow allocates a specific timeout to the receiver within the 20 seconds end-to-end timeout to respond to the payment message.

Scheme messages

In addition to the fundamental ISO20022 messages that revolve around payment use cases, such as the customer credit transfer (pacs.008) and request to pay (pain.013), these innovative real-time infrastructures have seamlessly integrated various administrative messages to ensure the smooth operational functioning of the network and its community. One prime exemplification of this is the admi.004 message, firmly established within the ISO20022 framework, as it assumes a pivotal role in expediting crucial administrative processes and upholding the system's integrity. This system notification message serves the crucial task of communicating operational information, such as planned downtimes and maintenance windows, to the participating entities. By promptly notifying the network's stakeholders of any scheduled disruptions or system enhancements, the admi.004 message ensures transparency, efficient planning, and seamless coordination across the real-time infrastructure.

The participant takes the responsibility of notifying the entire community regarding planned maintenance activities and the anticipated duration of unavailability. This proactive communication allows other participants to avoid sending transactions to the affected party, thus preventing transaction failures. Additionally, if a participant fails to update its local routing data to reflect the maintenance window, the central infrastructure will detect and reject any transactions directed towards that participant during the specified timeframe. This robust coordination and adherence to maintenance notifications not only safeguard the integrity of the payment ecosystem but also ensure the uninterrupted flow of transactions by proactively managing potential disruptions and minimizing any adverse impact on the overall network performance.

Tooling and operations

An essential component for the seamless operation of the institution within the infrastructure is a robust management console. This invaluable tool empowers teams within the institutions to efficiently monitor transaction statuses, conduct thorough payment investigations, manage liquidity through funding operations, and even provide the capability to retransmit files that might have been lost. With the aid of this comprehensive management console, financial institutions can optimize their operational efficiency, enhance risk management protocols, and ensure the smooth flow of critical payment processes.

Realtime monitoring

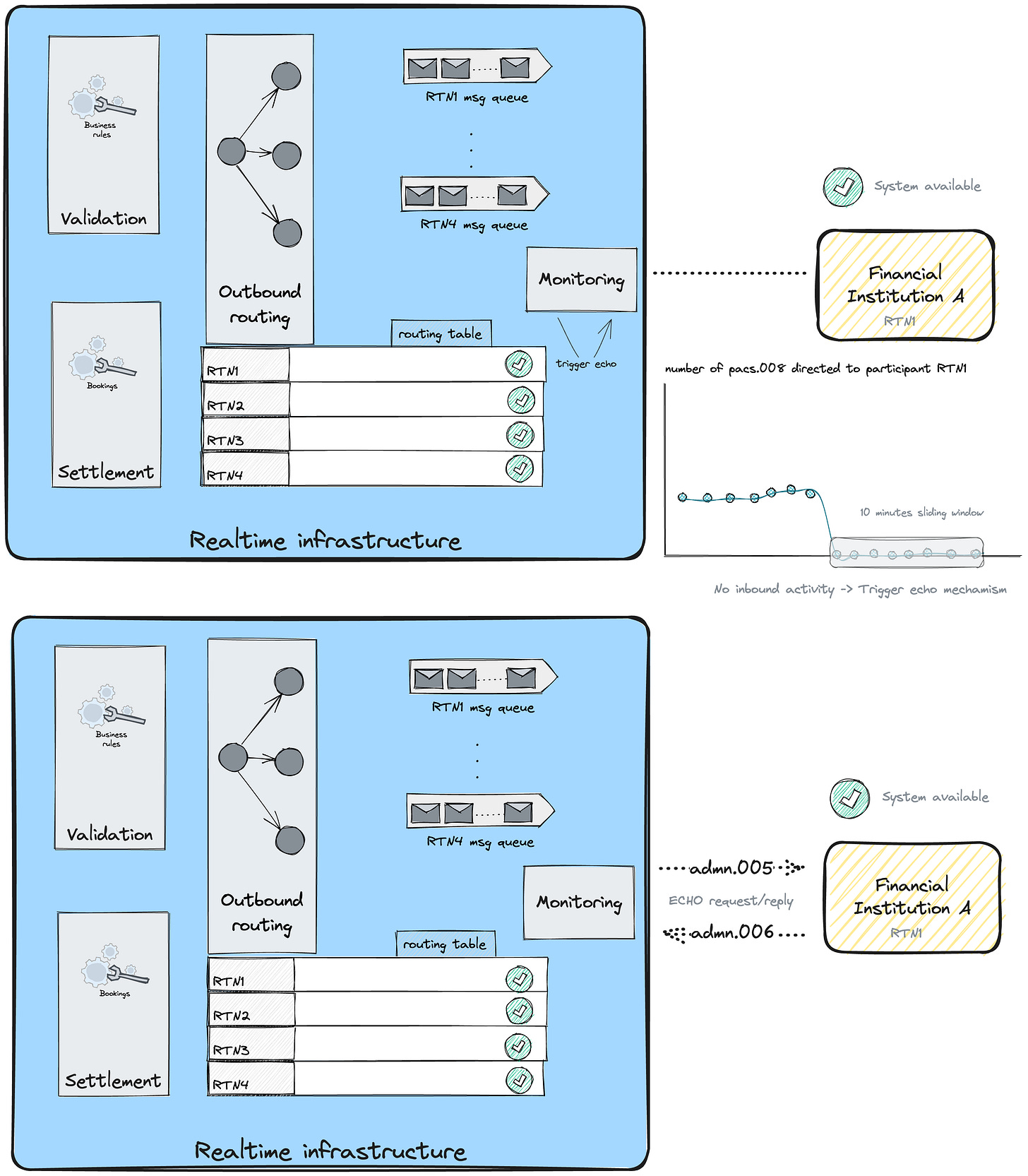

In addition to the mentioned elements, real-time payment infrastructures also incorporate sophisticated monitoring capabilities, a crucial aspect to ensure the seamless processing of payments. The ability to closely monitor participants within the ecosystem plays a pivotal role in maintaining the overall efficiency and reliability of the system. By continuously assessing the status of each participant, these infrastructures can promptly identify any connectivity or processing issues that may arise. This proactive approach allows for immediate action to be taken, such as rejecting traffic to the affected participant, thus preventing potential disruptions and ensuring uninterrupted payment flows.

The monitoring functionality operates as a vigilant guardian, constantly scanning for anomalies and deviations in participant performance. In the event of any network-related or processing hiccups, real-time infrastructures can swiftly alert relevant stakeholders, enabling them to swiftly address the underlying issues and implement remedial measures. This dynamic monitoring not only fortifies the integrity of the payment ecosystem but also enhances the overall end-user experience by minimizing delays and rejections. Additionally, the data and insights gleaned from the monitoring process provide valuable feedback to continuously refine and optimize the system's performance.

Participant monitoring can vary, ranging from active methods like health checks and heartbeats to passive strategies such as instrumenting internal infrastructure components or participant business metrics and behaviors.

Furthermore, the monitoring capabilities extend beyond individual participant performance, as they also encompass broader network health and traffic patterns. This comprehensive view of the infrastructure's overall functioning empowers operators to proactively respond to potential bottlenecks or capacity constraints, ensuring a scalable and resilient real-time payments ecosystem. By promptly adapting to changing circumstances, these infrastructures can accommodate the ever-growing demand for real-time transactions while maintaining impeccable security and stability.

Some domestic implementations of SICT use the pacs.008/pacs.002 message interaction of the customer credit transfer flow as echo signal by modeling a “fake” payment of 1€.

RTP network makes use of the admn.005 and admn.006 echo request and echo reply messages defined in the ISO20022. These messages come into play during periods of no transaction activity, acting as sentinels to inspect the availability of inactive participants. Through this approach, the RTP network keeps a vigilant eye on participant readiness, making certain that all entities remain fully engaged and responsive when the need arises.

In essence, the monitoring element in real-time payment infrastructures is an indispensable pillar that underpins the flawless operation of the system. Its constant vigilance, rapid response capabilities, and ability to detect and mitigate potential issues in real-time contribute to the robustness and trustworthiness of these innovative payment platforms. As real-time payments continue to revolutionize the financial landscape, the incorporation of advanced monitoring mechanisms ensures that participants can transact with confidence, while operators can efficiently manage and maintain the optimal functioning of the infrastructure.

As a final comment, it is worth noting that real-time payment infrastructures, unlike card networks, generally do not implement stand-in processes for handling situations when the destination is unavailable. Stand-in processes are more commonly associated with card networks, where a temporary transaction authorization can be provided by a designated standby institution or the card network itself when the card issuer's systems are not reachable.

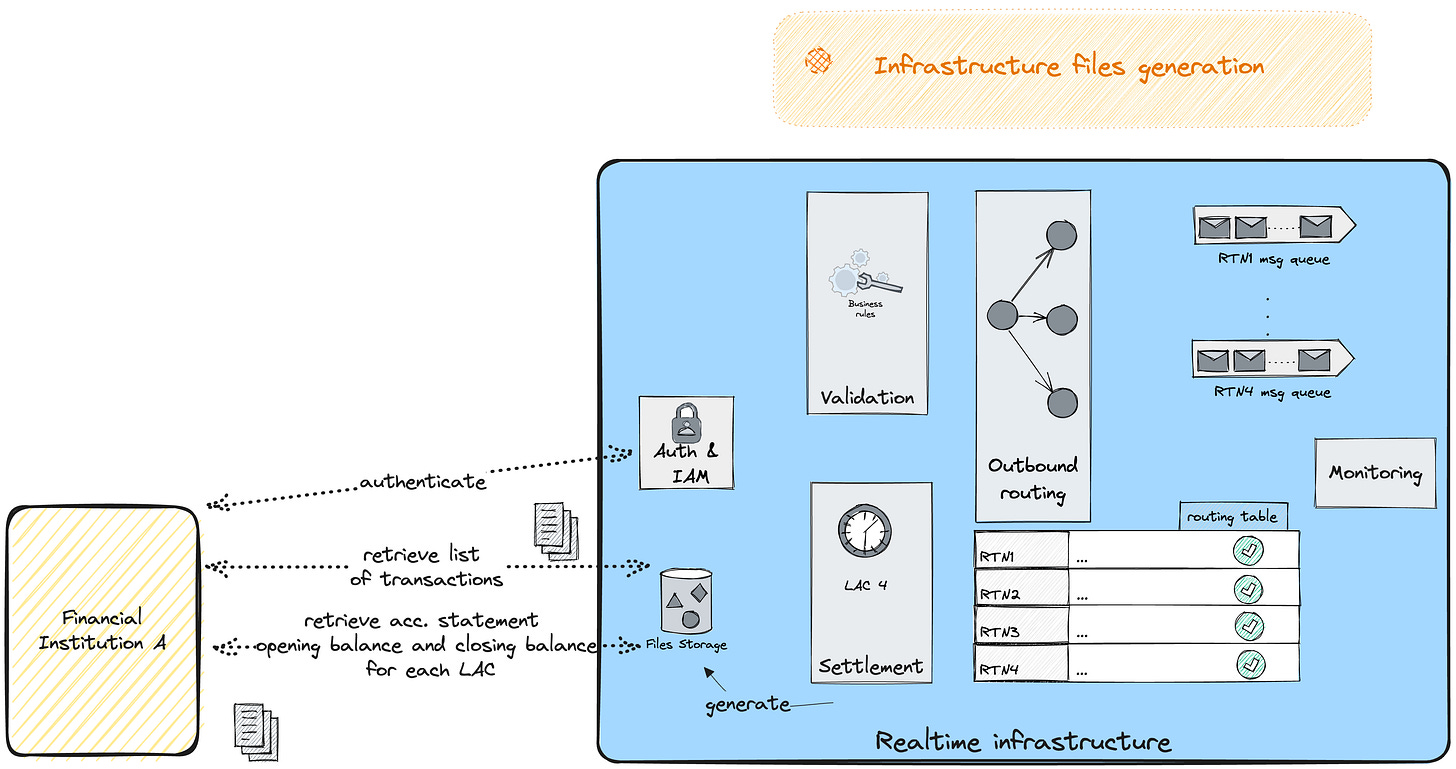

Infrastructure files

In these systems, participant-oriented files are commonly generated, like routing files updated with upcoming joiners to the community. Additionally, reconciliation files allow participants to verify their internal payment status against the settlement status. Moreover, settlement account reports provide essential details regarding the opening and closing balances of the session. These files play a crucial role in facilitating seamless and efficient operations management like reconciliation and liquidity management within the participant.

In conclusion, FedNow stands as a transformative force in the realm of real-time payments, promising to revolutionize the landscape of financial transactions in the United States. With its innovative architecture and commitment to interoperability, FedNow paves the way for seamless, secure, and instantaneous payments, benefiting businesses, consumers, and financial institutions alike. By harnessing the power of ISO20022 messaging and adhering to stringent operational standards, FedNow positions itself as a reliable and future-proof infrastructure for the ever-evolving payments ecosystem. An important element to consider is that request to pay has been incorporated into the initial release of FedNow, albeit without an alias mechanism. This leads us to speculate that the primary use cases envisioned for FedNow's early implementation are likely centered around bill payments rather than person-to-person transactions. As a final observation, it is rather intriguing that Adyen made it to the initial list of participants, while Stripe, on the other hand, did not.

What lies ahead? Following this informative introduction to the ISO20022 real-time system, we will be diving deep into FedNow's customer credits transfer flow next week, exploring its distinctions from its European counterparts, particularly its unique "accept without posting" option.