Deferred Net Settlement

Gain insights into the distinctive characteristics that set DNS apart from other settlement methods.

The efficiency and reliability of payment systems rely on robust clearing and settlement processes. Clearing involves the validation, matching, and reconciling of payment instructions between multiple parties, ensuring accurate and transparent transaction data. Once the clearing phase is complete, settlement takes place, which involves the actual transfer of funds to fulfill the payment obligations. These processes, often facilitated by central clearinghouses or automated systems, play a vital role in ensuring the smooth and secure movement of money, minimizing risks, and maintaining the integrity of financial transactions.

We will explore clearing mechanisms and their responsibilities in a future post however in this article, we will shift our focus to settlement, which is the process of actually transferring funds between the payer and payee's accounts.

As we discussed in our previous post, a bilateral settlement between parties was the norm, but over time centralized settlement models like interbank payment systems have emerged. Before jumping into multilateral settlement let's finish the analysis of bilateral settlement. Bilateral has several challenges that become apparent when we need to escalate the model to connect our institution to multiple parties. Payment participants need to send bilateral messages to each other, which can quickly become inefficient and cumbersome once the number of counterparties increases.

The number of bilateral agreements becomes unmanageable rapidly in terms of infrastructure connectivity cost and liquidity management. Each bilateral agreement requires dedicated connection points, which can be expensive and time-consuming to set up. Connectivity providers, such as SWIFT, impose a fee for every transaction sent, thereby adding cost to the bilateral settlement process. These fees, combined with other expenses related to bilateral settlement, further contribute to the overall financial burden and increase the unit cost associated with each transaction.

Banks are interested in decreasing the unit economics of their transactions. Payment infrastructures have fixed and variable costs, and maximizing the efficiency of clearing and settlement processes reduces both.

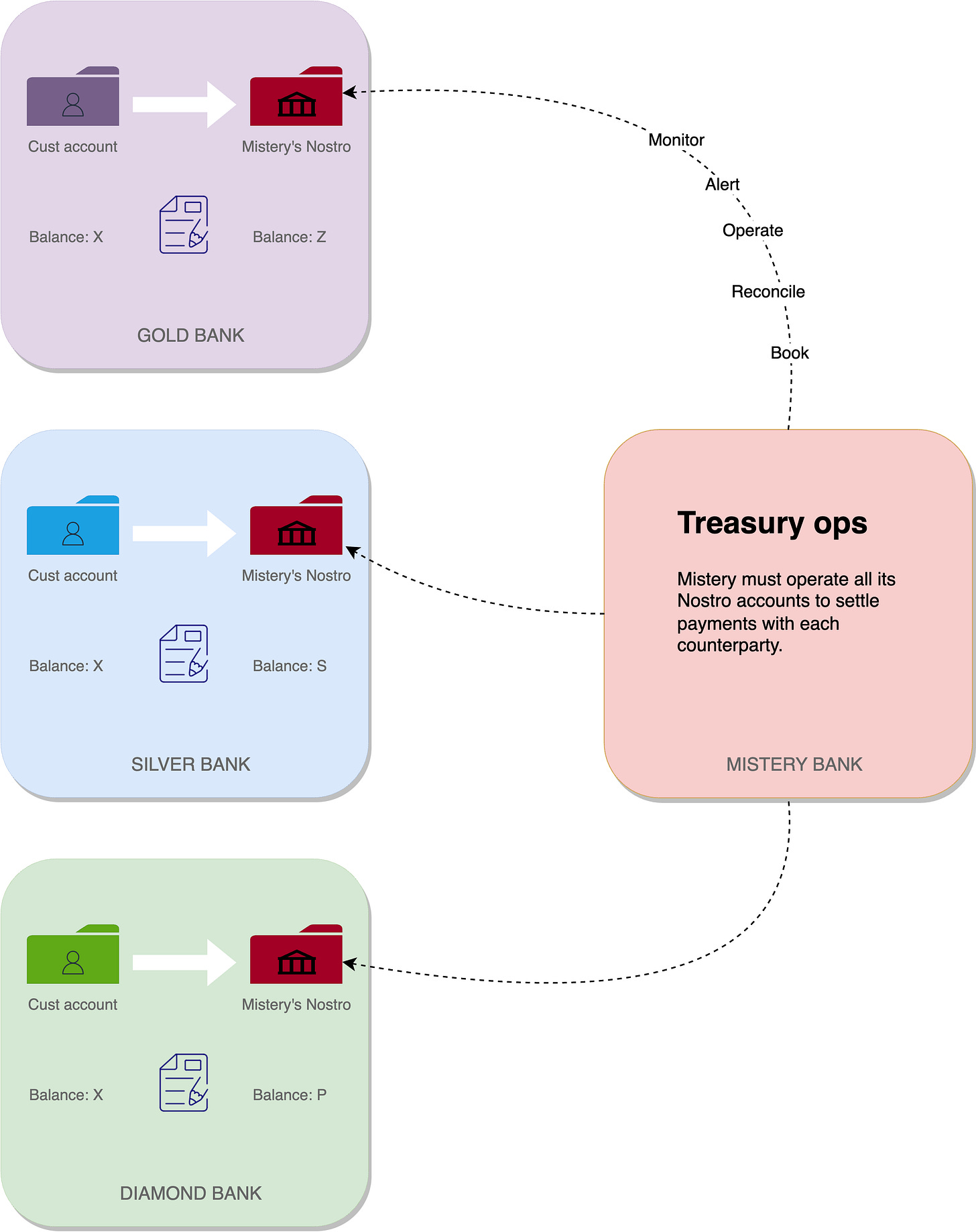

Find below a simplified scenario of having multiple bilateral agreements and therefore Nostro accounts.

In addition to the financial implications associated with connectivity costs, it is crucial to emphasize another critical aspect that becomes evident when examining the diagram above. Mistery Bank must import and maintain liquidity in all its Nostro accounts to meet the demands of those bilateral agreements, which can be an enormous liquidity burden and a treasury operational cost. It is essential to continuously monitor the Nostro account to ensure sufficient funds are available and maintain its financial stability. Additionally, regular reconciliation of the account is crucial to maintain accurate financial records and ensure proper account management.

Bilateral settlement serves as an excellent means for banks to establish connections with institutions that are unable to participate in multilateral arrangements: corporates, fintechs and public institutions.

The banking community has implemented two approaches to effectively address these challenges. The first approach is embracing centralized settlement models such as interbank infrastructures, ACHs and CSMs, and the other is adopting new settlement technologies such as distributed ledger technology.

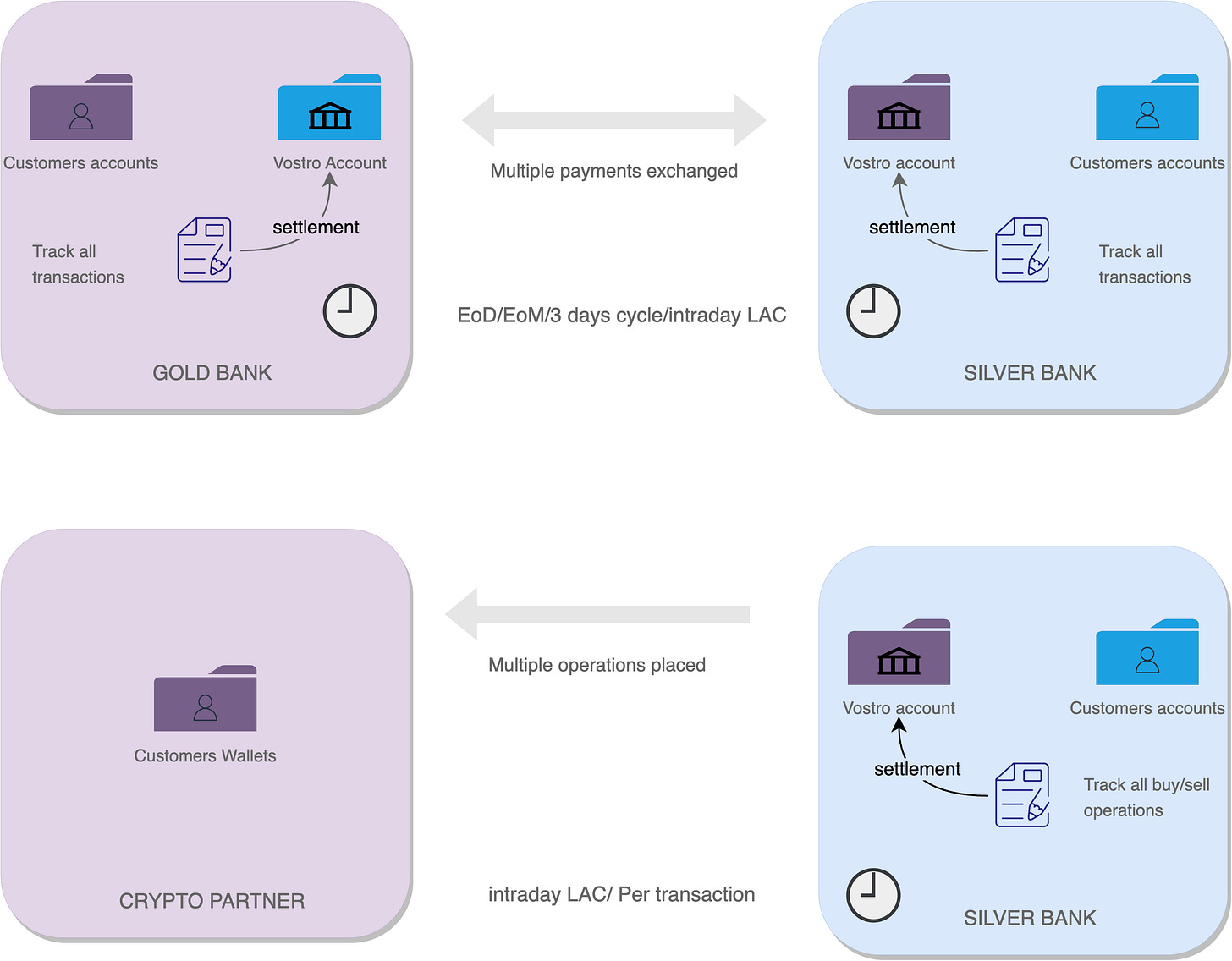

The second approach is implementing the consolidation of multiple payments into a single settlement transaction, driven by the understanding that the probability of a customer from Gold Bank initiating a payment to Silver Bank is equally likely as the reverse scenario on any given day. Thus, instead of settling each transaction individually, netting enables participants to consolidate payment flows and simultaneously settle the overall balance. This approach not only reduces settlement risk and liquidity demands but also minimizes the number of transactions that need to pass through connectivity providers such as SWIFT. The term deferred refers to the timing of the settlement, which typically occurs at the end of each day, month or specified time period. DNS can be employed in both bilateral and multilateral configurations, offering flexibility and adaptability to accommodate various payment arrangements.

The previous diagram illustrates the operational mechanics of DNS in a bilateral agreement, demonstrating its applicability not only between banks but also between banks and institutions that are not involved in any Automated Clearing House (ACH) systems, thereby making bilateral settlement the sole viable option in such cases.

Despite the perception that the bulkiness and deferred nature of Deferred Net Settlement (DNS) may hinder its suitability for real-time payments, it is important to note that several real-time systems operate based on the DNS principle. These systems enable immediate payment bookings while deferring the final settlements. Notable examples of such implementations include Faster Payments FPS in the UK and the card networks of Visa and Mastercard. This demonstrates that DNS can effectively accommodate the dynamics of real-time payment processing while ensuring secure and efficient settlement procedures..

Mastercard utilizes a deferred net settlement mechanism for its card scheme settlement. In this approach, transactions are accumulated and processed in batches rather than settled individually in real-time. At predetermined intervals, the net amount owed between participating banks is calculated, and settlements are made based on the final net positions. Visa, similar to Mastercard, also employs a deferred net settlement mechanism for its card scheme settlement. Transactions made through the Visa network are accumulated and processed in batches, and at regular intervals, the net amounts owed between participating banks are calculated.

Exciting new article coming soon: Get ready for a journey into the world of RTGS, discover its advantages over DNS and explore its impact on liquidity!