Collections and Mandates: A Comprehensive Guide

Automating Payments: Unpacking collections and mandates for seamless financial transactions

Welcome to The Engineer Banker, a weekly newsletter dedicated to organizing and delivering insightful technical content on the payments domain, making it easy for you to follow and learn at your own pace

The modern consumer ecosystem, which is increasingly moving towards automation and ease-of-use, has popularized 'collections', also known as 'direct debits'. Deployed in nearly every country around the world, these systems present a convenient way to manage regular payments for products and services. Collections are one of the most popular pull methods available, let's explain how they work with an example.

Consider a situation where you're signing up for a gym membership, a service that typically requires consistent monthly payments. To keep your membership active, you need to ensure the gym receives your payment every month, a task that may slip your mind amidst the bustle of daily life. Enter the collections and mandate system, an automated solution that eradicates the need for you to remember to transfer the money manually each month.

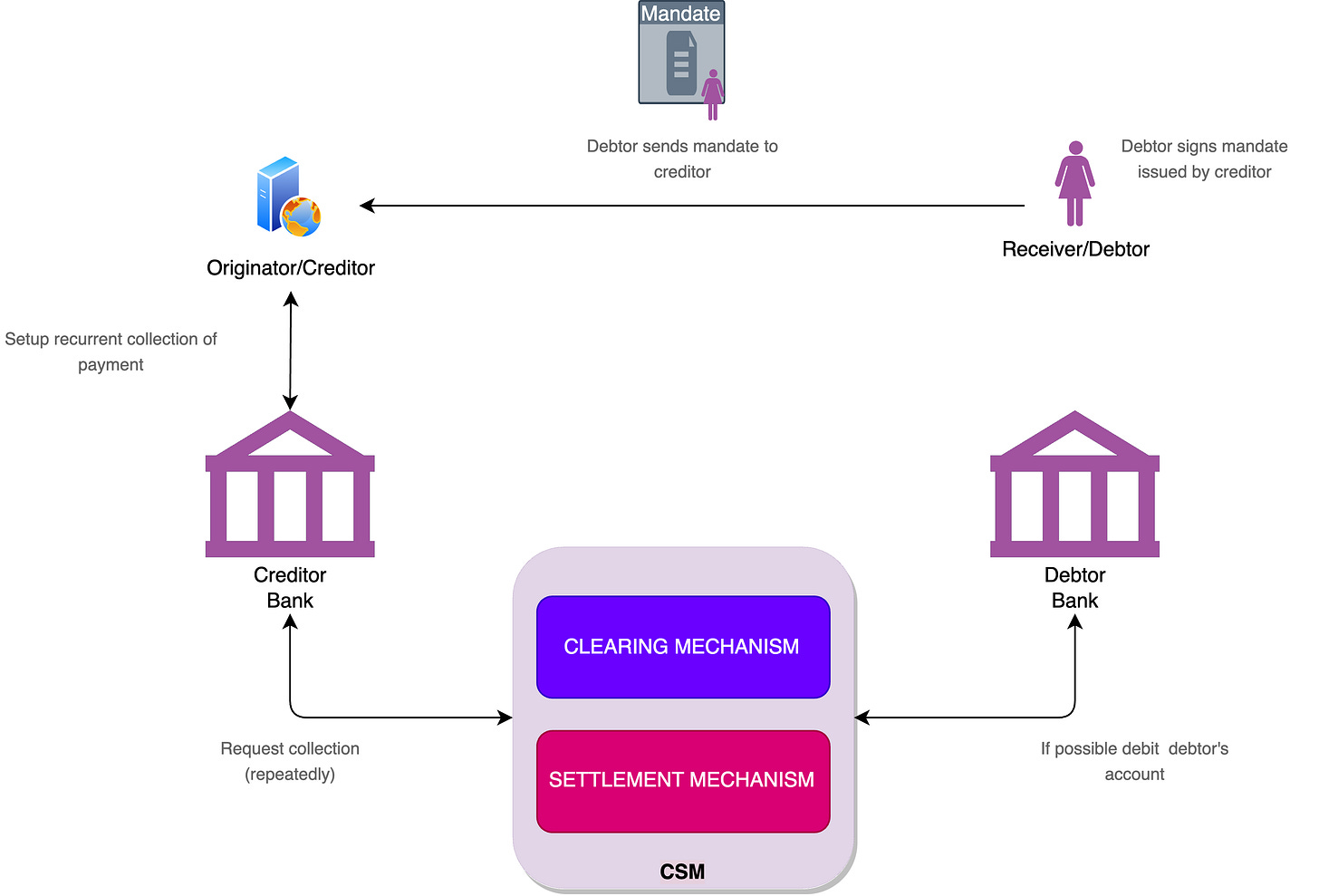

Collection and mandates work together to simplify the payment process.

A mandate is like giving permission for someone to collect money from your account on a regular basis. It's similar to setting up an automatic payment authorization. You provide your payment details once, such as your bank account information, and give permission for the gym to collect the monthly membership fees directly from your account.

With this setup, you don't have to worry about remembering to make the payments or risking any late fees. The gym can simply initiate the collection process, and the agreed amount will be automatically deducted from your account. It's like having a trusted friend who knows exactly when and how much to collect from you, so you can focus on enjoying your gym sessions without the hassle of manual payments.

This example of a gym membership, though simple, encapsulates the wider functionality and convenience of the collections and mandate systems. The implications of such systems extend far beyond gym memberships, to various areas of our lives where regular payments are required.

For instance, think about your monthly utility bills like electricity, water, and broadband internet. Without the collections and mandate system, you would have to remember to make each of these payments individually every month. The traditional approach might involve keeping track of the due dates, manually initiating the payment, and waiting for confirmation. However, with the collections and mandate system, all you need to do is provide your payment details and grant permission once. Following this, your service provider can directly debit the amount from your account on the agreed date.

Or consider the case of a streaming service subscription. With a collections and mandate system in place, you wouldn't have to worry about your subscription being abruptly interrupted due to non-payment. Instead, the service provider would automatically debit the subscription amount from your account each month, ensuring uninterrupted access to your favorite shows and movies.

The beauty of the collections and mandate system lies not only in its simplicity but also in the control it offers to consumers. You can usually revoke or change the mandate at any time, offering you flexibility and control over your finances. A crucial component of the collection and direct debit process is the mandate. The mandate, in essence, serves as the consent or permission a customer provides to an organization, authorizing it to collect funds from their account regularly.

The mandate is a legally binding contract that outlines the terms and conditions of the recurring payment arrangement.

The use of mandate systems is widely seen in many countries around the world, due to their convenience, reliability, and legal robustness. In fact, they are the backbone of automated recurring payment structures.

In the United Kingdom, for example, the Direct Debit Guarantee protects customers who use direct debit as a payment method. This guarantee assures the customer that if a mistake is made in the payment process, whether by the organization, bank, or building society, the customer is entitled to a full and immediate refund of the amount paid. The direct debit process in the UK cannot take place without a signed Direct Debit Instruction (DDI), which is essentially the mandate given by the customer to the organization and their bank.

The European Union offers a similar system known as SEPA Direct Debit (SDD). Under the SEPA Core Direct Debit Scheme, creditors (the organization collecting the funds) must obtain a mandate signed by the debtor (the customer) before initiating collections. This mandate is valid until it is revoked, offering a simple, straightforward way for EU consumers and businesses to make recurring payments.

In the United States, the concept of mandates is found within the framework of Automated Clearing House (ACH) payments, particularly for recurring payments. Here, the mandate is often termed as an 'authorization', and the National Automated Clearing House Association (NACHA) requires that businesses obtain a "written authorization" from customers before debiting their account.

Australia and New Zealand also have well-established direct debit systems. In Australia, it is regulated by the Australian Payments Network (AusPayNet) which requires a Service Agreement (essentially the mandate) to be established between the customer and the business. In New Zealand, direct debit is governed by the Bulk Electronic Clearing System (BECS), and a Direct Debit Authority serves as the mandate for recurring payments.

In all these systems, the mandate is the cornerstone of the entire process, ensuring transparency and legality. It serves to protect both the customer and the business. For customers, mandates provide assurance that their money will only be withdrawn with their prior consent and according to the agreed terms. For businesses, obtaining a mandate reduces the risk of payment disputes and chargebacks. The mandate systems in these countries illustrate how mandates have become a standardized, legally binding method to ensure the smooth operation of direct debits. While the exact rules and protections vary by country, the core principle remains the same: a customer gives an organization permission to withdraw money from their account on a recurring basis, simplifying payments for both parties.

The implementation of mandates has indeed evolved over time to adapt to our increasingly digital world. While traditionally, mandates were often signed in paper form, digital or electronic mandates have become much more common due to their convenience and efficiency. Known as e-mandates, these are digital versions of the traditional paper mandates. The advent of e-mandates has enabled quicker, more streamlined setup processes for direct debit arrangements. They're generally more efficient, not just from a consumer perspective, but for businesses as well, cutting down on processing time and reducing paper usage. That being said, it's essential to note that the acceptance and legality of e-mandates can vary by country and by the specific regulations set by the financial governing bodies in those countries. For instance, in the SEPA (Single Euro Payments Area) zone, the use of e-mandates is widely accepted. In the United States, NACHA (National Automated Clearing House Association) rules permit electronic authorizations as well.

BACS (Bankers' Automated Clearing Services) in the UK does use electronic forms of mandates. Known as "e-mandates" or "Paperless Direct Debit" (PDD), these are a more modern, efficient alternative to traditional paper Direct Debit Instructions (DDI). The system enables customers to authorize Direct Debit Instructions electronically without the need for a physical, paper-based mandate. This not only makes the process more efficient and environmentally friendly, but also more convenient for customers and businesses alike. Paperless Direct Debit is fully approved by BACS and regulated by the Direct Debit scheme rules. Customers are still covered by the Direct Debit Guarantee, which means they are entitled to a full and immediate refund of the amount paid if a mistake is made in the payment process.

However, not all countries or banks have fully transitioned to electronic mandates. Some still require paper mandates, especially for certain types of transactions. Others may accept both forms, offering consumers and businesses a choice between digital and traditional paper mandates.

The management of the mandate can follow two different models CMF and DMF. CMF provides that the mandate is stored with the Creditor and it is the unique model in four European countries (Germany, Spain, Netherland and UK). DMF, unlike the previous, provides that the mandate stays with the Debtor’s bank and is adopted in Finland, Greece, Malta, Slovenia, Slovakia,Hungary, Latvia and Lithuania. In Italy and in the remaining countries of SEPA area, CMF and DMF coexist.

Creditor driven mandate flow

Under the Creditor Mandate Flow (CMF), the onus is on the creditor (the organization or business) to issue, manage, and monitor the direct debit mandate throughout its lifecycle. This encompasses everything from the moment the customer completes and signs the mandate to the point where it's revoked, cancelled, or expired. For instance, either the debtor (customer) or the creditor may need to amend the mandate-related information (MRI). It is incumbent upon the creditor to capture all these modifications and update the mandate accordingly.

As stipulated by the Single Euro Payments Area (SEPA) Implementation Guidelines, creditors are obliged to incorporate MRI within their direct debit collection messages. An illustrative example here might involve a utility company needing to include specific customer agreement details (MRI) when initiating a monthly bill payment through SEPA Direct Debit.

While the creditor's bank receives this MRI, it does not possess the capacity to verify the legitimacy of a mandate, as it does not have a direct relationship with the debtor. Consequently, it must operate on the basis of trust, accepting that the creditor has obtained formal approval from the debtor to establish the mandate.

However, this is not to suggest that the creditor's bank has no responsibilities. The European Payments Council (EPC) requires them to ensure that only credible billers initiate payments via SEPA Direct Debit. This necessitates a level of due diligence on behalf of the creditor's bank, akin to Know Your Customer (KYC) compliance requirements in banking. Thus, the creditor's bank must comprehensively understand its client (the biller) before processing collections on their behalf.

Conversely, the debtor's bank does not receive any MRI directly from the debtor, instead, it gets the MRI through direct debit collection messages. Like the creditor's bank, it more or less processes direct debits based on trust. For example, it is not required to check if the creditor is authorized to collect payment from the debtor's account.

However, in practice, debtor banks usually create and store mandates upon receiving the first collection. For instance, if a customer authorizes a gym to debit their monthly membership fee via direct debit, the customer's bank (the debtor's bank) will record the mandate details when the first payment is initiated. Subsequent collections may then be rejected if the mandate has expired or was revoked by the customer, thus ensuring the safeguarding of the customer's interests.

Debtor driven mandate flow

Under the Debtor Mandate Flow (DMF), the responsibility of issuing and managing the direct debit mandate throughout its lifecycle rests with the debtor's bank. In this model, while it's the creditor who sells products or services to the debtor, the debtor's bank plays an essential role in the mandate issuance.

This process can be elucidated with an example: let's say a customer (debtor) subscribes to a monthly streaming service (creditor). Here, it's the creditor who notifies the customer's bank about the need for a mandate, prompting the bank to issue and send the mandate to its customer. Thus, the debtor's bank must facilitate communication channels to the creditor for this purpose.

In the DMF, the creditor is also required to send collection requests to their bank, along with mandate-related information (MRI). As the mandate is generated by the debtor's bank, the biller does not possess this MRI. This necessitates the debtor's bank to make the MRI accessible to the creditor as well, which demands specific system configurations and processing.

It's important to note that the DMF is inherently more complex than the Creditor Mandate Flow (CMF) due to the additional steps involved in the information exchanges between the parties.

Given that the debtor's bank is the originator of the mandate in DMF, it possesses the MRI even before the first collection request is received from the creditor's bank. As a result, it can verify at the reception of the first direct debit if the mandate already exists. For subsequent collections, it can carry out checks on the mandate before processing it.

Although these controls and verifications are not mandated by the Single Euro Payments Area Direct Debit (SDD) schemes, debtor's banks typically implement them. This is largely because they shoulder a greater responsibility toward the creditors and their customers, given their role in mandate management. The checks act as safeguards to ensure the integrity of transactions and protect the interests of all parties involved.