Understanding the Four Corner Model

Unlocking the key elements to understanding transaction flows

Welcome to The Engineer Banker, a weekly newsletter dedicated to organizing and delivering insightful technical content on the payments domain, making it easy for you to follow and learn at your own pace

In the ever-evolving world of payments, understanding the underlying transaction flows is crucial to grasp the intricacies of the payment ecosystem. One model that serves as the foundation for comprehending these flows is the Four Corner Model. In this article, we will dive into the essence of the Four Corner Model, explore its significance in payment processing, and provide real-life examples to illustrate its application. The Four Corner model is at the basis of the vast majority of traditional payments systems. It is called the Four Corner model because four main actors participate in the process of sending and receiving funds.

The Four Corner Model acts as a conceptual framework that maps out the flow of information and funds in a payment transaction.

It provides a holistic view of the various participants involved and their roles in facilitating a successful payment. By dissecting the transaction into its four distinct corners, we gain a comprehensive understanding of how payments traverse through multiple entities, systems, and channels. Understanding the Four Corner Model provides valuable insights into the underlying flow of information and funds in card payment transactions. This knowledge helps stakeholders in the payments ecosystem, including financial institutions, merchants, and consumers, to navigate the payment landscape more effectively and ensure smooth, secure transactions. Exploring the Four Corners:

Payer's Corner

The first corner represents the payer, the party initiating the payment. This can be an individual, a business, or any entity making a financial obligation. The payer's corner encompasses activities such as initiating the payment, verifying the availability of funds, and authorizing the transaction.

Payee's Corner

The second corner represents the payee, the recipient of the payment. This can be a merchant, a service provider, or any entity expecting to receive funds. The payee's corner involves providing necessary payment details, such as account information or a unique identifier, to enable the receipt of funds.

Acquirer's Corner

The third corner represents the acquirer, typically a financial institution that acts as an intermediary between the payer and the payee. The acquirer plays a vital role in processing the payment, validating its authenticity, and ensuring funds are transferred securely from the payer to the payee.

Issuer's Corner

The fourth corner represents the issuer, which is the financial institution that issued the payment instrument used by the payer. This can be a bank, a credit card company, or any entity responsible for providing the payment instrument, such as a credit card or a digital wallet. The issuer's corner involves validating the payer's identity, verifying available funds, and facilitating the authorization and settlement of the payment.

Real-Life Case Studies: The Four-Corner Model in Action

To grasp the practical application of the Four Corner Model, let's consider two scenarios:

Card Payment

In a card payment transaction, the payer's corner includes the cardholder initiating the payment, while the payee's corner involves the merchant or business accepting the card payment. The acquirer, positioned in the acquirer's corner, verifies the transaction and facilitates the authorization and settlement process. The issuer, in the issuer's corner, validates the cardholder's identity, confirms available funds, and ensures a successful payment.

Let's imagine a scenario where a customer visits a retail store and makes a purchase using a credit card. The transaction flows through each corner of the Four Corner Model as follows:

Payer's Corner: The customer, also known as the payer, decides to make a payment using their credit card. They swipe or insert their card into the store's payment terminal, initiating the payment process. The payer's corner involves the customer authorizing the payment by entering a PIN or providing a signature for verification purposes.

Payee's Corner: The retail store, serving as the payee, receives the payment information from the payer. The store's payment terminal captures the card details, including the card number, expiry date, and CVV (Card Verification Value). These details, along with the transaction amount, are transmitted to the next corner of the model for further processing.

Acquirer's Corner: In the acquirer's corner, the payment information from the retail store's payment terminal is routed to the acquiring bank or payment processor associated with the merchant. The acquirer acts as an intermediary, facilitating the transaction between the retailer and the issuer. The acquirer performs several critical tasks, including verifying the transaction's legitimacy, conducting fraud checks, and obtaining authorization from the issuer for the payment. The acquirer validates the payer's available credit or funds, ensuring they are sufficient to cover the transaction amount. Once the acquirer receives authorization from the issuer, it communicates the approval back to the retail store's payment terminal, indicating that the payment is successful and can proceed to settlement.

Issuer's Corner: In the issuer's corner, the card issuer (such as a bank or credit card company) plays a vital role. Upon receiving the authorization request from the acquirer, the issuer verifies the payer's identity, confirms the available credit or funds, and assesses whether the transaction aligns with the cardholder's spending patterns and transaction history. If all the criteria are met, the issuer grants authorization for the payment and sends the approval back to the acquirer. The issuer's corner also involves deducting the authorized amount from the cardholder's available credit limit or debiting the corresponding funds from their linked account. Ultimately, the successful completion of the card payment transaction relies on the seamless interaction and coordination among the payer, the payee, the acquirer, and the issuer—representing the four corners of the model. It's important to note that this example represents a simplified version of a card payment transaction. In practice, there are additional layers of security measures, risk assessments, and backend processes involved to ensure the transaction's integrity and protect against fraudulent activities.

Bank Transfer

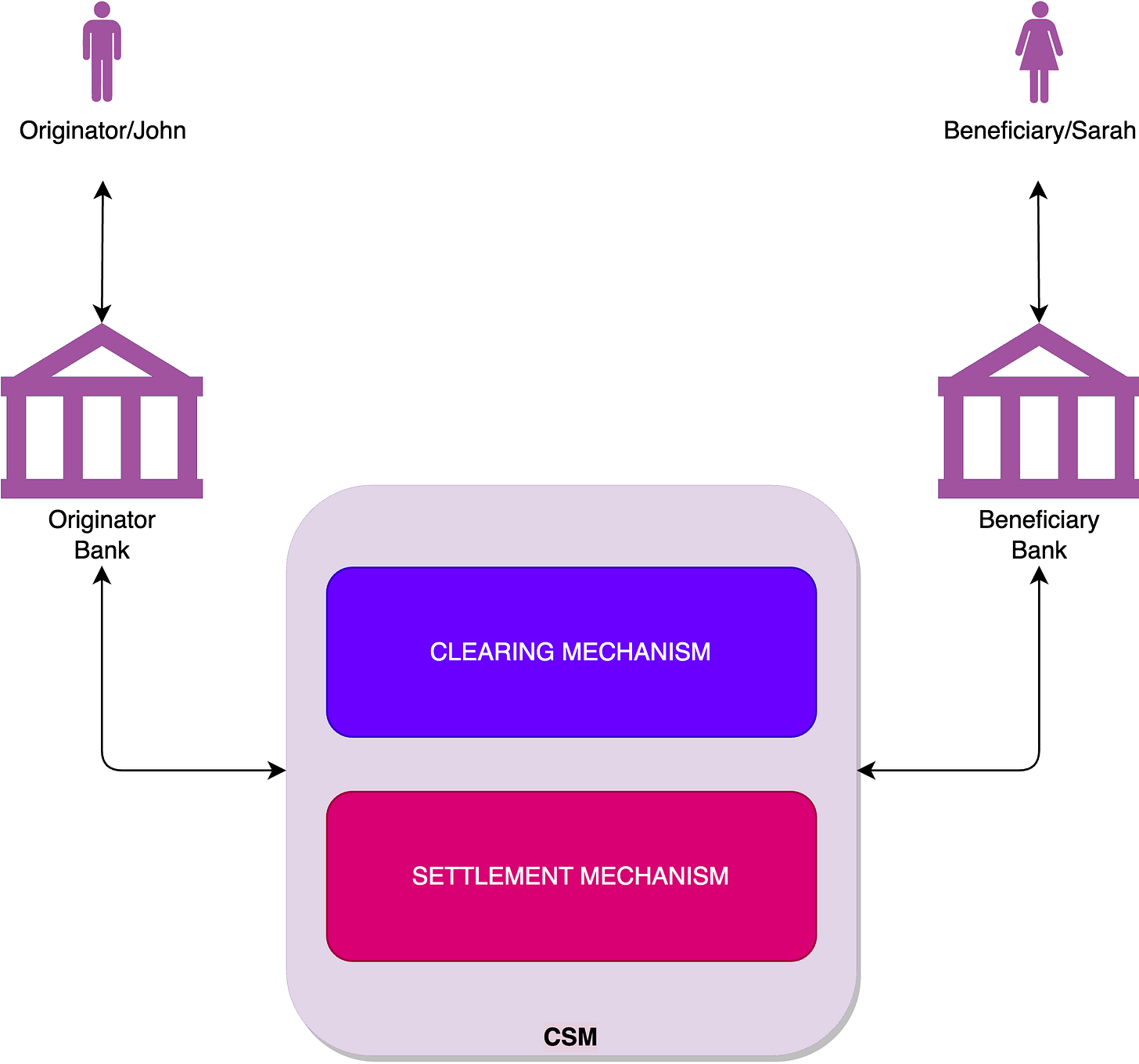

In a bank transfer wording is a bit different than in a card transaction however the corner remains applicable, the originator's corner encompasses the individual or business initiating the transfer, while the beneficiary's corner involves the recipient's bank account details. The originator's bank, positioned in the originator's bank corner, verifies the transaction, facilitates the transfer, and ensures compliance with regulatory requirements. The beneficiary's bank receives the funds and credits them to the payee's account.

Imagine that John wants to transfer money from his bank account to his friend Sarah's bank account. The transaction follows the Four Corner Model as follows:

Originator's Corner: John, the payer, initiates the bank transfer transaction. He logs into his online banking platform or visits his bank's branch to provide the necessary instructions for the transfer. John specifies the recipient (Sarah) and the amount he wishes to transfer from his account to hers. He may also include a reference or purpose for the transfer, such as "Payment for dinner."

Beneficiary's Corner: Sarah, the payee, provides her bank account details to John, including her account number, bank name, and possibly the branch or routing information. Sarah ensures that she provides the correct and up-to-date information to avoid any errors in the transaction.

Originator’s Bank Corner: In this context, the acquirer's corner represents John's bank. John's bank acts as the acquirer, processing the outgoing bank transfer request. The bank validates John's identity and account details to ensure he has sufficient funds or credit available for the transfer. The bank may also apply any relevant fees or charges associated with the transaction. Once the bank confirms that John's account can support the transfer, it begins the process of transferring funds to Sarah's bank account. The bank creates a payment order, including the necessary information provided by John, such as the recipient's account details and the transfer amount.

Beneficiary’s Bank Corner: In the bank transfer example, Sarah's bank acts as the issuer. John's bank sends the payment order to Sarah's bank, requesting the transfer of funds to her account. Sarah's bank verifies the authenticity and accuracy of the payment order, ensuring that it aligns with the account information provided by Sarah. Once Sarah's bank confirms the validity of the payment order, it credits the transferred amount to Sarah's account. The issuer's corner involves updating the account balances, recording the transaction details, and providing the necessary notifications or confirmations to both Sarah and John. Throughout the process, communication occurs between the acquirer (John's bank) and the issuer (Sarah's bank) to facilitate the successful completion of the bank transfer. This communication includes exchanging information related to the transaction, such as payment instructions, account verification, and confirmation of the transfer.

The Four Corner Model serves as a fundamental framework for understanding payment flows and the roles played by different entities involved in a transaction. By breaking down the payment process into its four distinct corners, we gain a comprehensive view of how payments move from the payer to the payee. This model helps in identifying potential bottlenecks, ensuring transaction security, and enabling efficient payment processing. By grasping the intricacies of the Four Corner Model, we unlock a deeper understanding of the payments landscape and its impact on various stakeholders.