Payments Infrastructure Anatomy I

Learn the ecosystem behind a payments infrastructure

While our "Mastering the Fundamentals" series is still ongoing, we're excited to introduce a more advanced piece for all you payments enthusiasts out there. If you're already familiar with the basics, get ready to take your knowledge to the next level as we explore payments systems in greater detail!

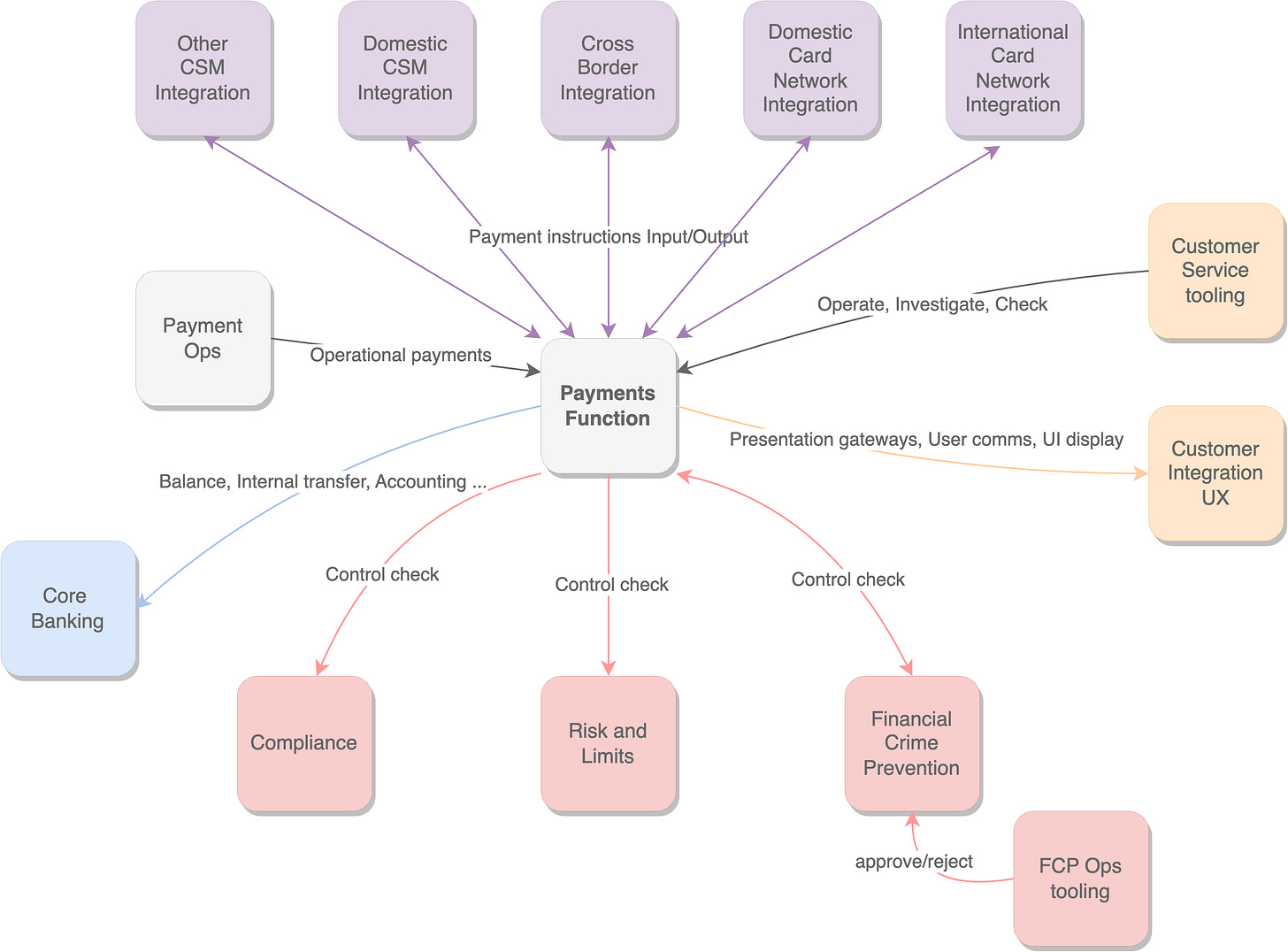

In today's article, we'll take a close look at the boundaries and high-level functional blocks that make up the foundation of a payments infrastructure within a bank or fintech. This topic is of great importance as the payments infrastructure plays a crucial role in enabling seamless and secure transactions for customers. To understand the anatomy of a payments infrastructure, we need to first identify the main components that make up the infrastructure. Within the realm of a bank or fintech organization, the payments function plays a crucial role intertwined with various dependencies across different facets of the organization, intricately connected to the underlying infrastructure. It serves as a critical artery, facilitating seamless transactions while closely interacting with departments such as risk management, compliance, customer support, reporting, core banking and platform engineering. Understanding the intricate interplay between these interconnected components is vital for optimizing payment processes and ensuring smooth operations within the organization.

Payments infrastructure is a complex web of processes and systems that must work in harmony to ensure the timely and secure transfer of funds.

For a visual representation of the interfaces between payments core function and other functional blocks within the organization take a look at the dependencies diagram below.

Check out the diagram above to get a glimpse of how the payments function is intertwined with a whole bunch of other functions and infrastructure components. These connections play a significant role in shaping and impacting the journey of a payment. Think of the payment lifecycle as a wild ride, with different stages and states that a payment can go through. But hold on tight, because in a future post, we'll dive deep into the nitty-gritty of the typical payment lifecycle. But before we do that, let's roll up our sleeves and dig into each of these dependencies, unpacking their inner workings and while we look at the interfaces between functions keep the following sentence in mind.

Core banking systems

There's a crucial intersection point with core banking systems. Core banking forms the foundation of a financial institution, handling essential banking functions like customer data, KYC data, customer accounts, account deposits, account withdraws, account holds, account balances (bank, usable and available balance), transactions and its history. The payments function relies heavily on this core banking infrastructure to facilitate the movement of funds and ensure accurate recording of transactions. Imagine you're making a payment from your bank account to another person. Behind the scenes, the payments function communicates with a core banking system to verify your account balance for example.

The integration between payments and core banking allows for seamless fund transfers, real-time balance updates, and proper transaction reconciliation. It ensures that your payments are securely processed, and your account information remains up to date.

Risk and Limits

Another crucial dependency that payments rely on is risk management and limits. They ensure that transactions are monitored, evaluated, and managed in accordance with the institution's risk appetite and regulatory requirements. Risk management and compliance play a critical role in payments because payments involve the transfer of money and sensitive financial information, which makes them attractive targets for fraudsters and cybercriminals.

Therefore, comprehensive risk management strategies and compliance frameworks are necessary to safeguard against potential risks such as fraud, money laundering, and data breaches. The payments function collaborates closely with risk and limits management systems to ensure that transactions are conducted within acceptable risk parameters and predefined limits. Let's say you're making a large payment that exceeds your usual transaction amount. The payments function will interact with the risk and limits management systems to assess the transaction's potential risk. It will check factors like your transaction history, account balance, and any established limits.

If the transaction falls within the acceptable risk tolerance and limit thresholds, it will proceed smoothly. However, if it exceeds the predefined limits or raises red flags in terms of potential fraud or suspicious activity, the risk and limits management systems may intervene. They might trigger additional security checks, require further authorization, or even block the transaction altogether to protect you from potential financial risks. Moreover, risk and limits management are not only important for customer protection but also help to prevent financial losses for banks.

The collaboration between the payments function and risk and limits management is crucial for maintaining a secure and controlled payment environment.

Financial Crime Prevention

Much related to the previous point, financial crime prevention or FCP is another critical aspect of payments infrastructure. As financial transactions flow through the payment infrastructure, they are closely monitored and scrutinized to detect and prevent any potential financial crimes, such as money laundering, fraud, or terrorist financing. We can break down FCP into two subcategories:

Transaction Monitoring: FCP domain microservices employ sophisticated transaction monitoring systems that analyze payment data in real-time. These systems use advanced algorithms and pattern recognition techniques to identify suspicious activities, unusual transaction patterns, or potential red flags that could indicate illicit financial behavior. In a future post we will explore the rapid movement of funds control check in-depth, so make sure to stay tuned and subscribe to stay in the loop and never miss out.

Know Your Customer (KYC): Payments systems often integrate with KYC processes to gather essential information about customers, such as their identity, source of funds, and transaction history. This helps in assessing the legitimacy of transactions and mitigating the risk of financial crime.

By integrating financial crime prevention measures within the payments function, financial institutions can proactively identify and address potential risks, protect their customers and reputation

Regulatory Compliance

Compliance with regulatory requirements is another crucial aspect of payments infrastructure. The payments function ensures adherence to relevant regulatory requirements and compliance frameworks related to financial crime prevention. This includes implementing robust policies, procedures, and controls to combat money laundering, terrorist financing, and other illicit activities. One of the most important regulatory aspects that a bank is obligated to act on is Anti-Money Laundering. Payment processes incorporate AML compliance measures to ensure that funds are not being used for money laundering activities. This involves verifying customer identities, conducting due diligence checks, and reporting any suspicious transactions to regulatory authorities as required by law.

Compliance extends beyond anti-money laundering (AML) as financial institutions must adhere to various regulatory bodies to ensure the proper and compliant processing of payments. These regulatory bodies encompass a range of requirements, such as data privacy, consumer protection, sanctions screening, and financial reporting. Compliance teams work diligently to navigate and comply with the diverse regulatory landscape, ensuring that payment processes align with the specific rules and regulations set forth by each governing body. By doing so, banks can operate within the legal framework, uphold industry standards, and maintain the integrity and security of the payment ecosystem.

You can continue exploring those interfaces by by checking out our second installment:

Payments Infrastructure Anatomy II

In Today's article, we will continue discussing the relationship between payments and neighboring functions in a bank or fintech ecosystem. If you missed our previous article we invite you to take a moment to visit it and refresh your understanding of the infrastructure interfaces we discussed in our first installment.