The Power of ISO 20022 IDs and References

Identifiers for Financial Efficiency

Welcome to The Engineer Banker, a weekly newsletter dedicated to organizing and delivering insightful technical content on the payments domain, making it easy for you to follow and learn at your own pace.

Welcome to another episode of Payment Bites. Today, we'll delve into the diverse world of identifiers and references commonly encountered in ISO 20022 credit transfers. At its core, ISO 20022 is designed to facilitate precision, consistency, and interoperability in financial communication. Identifiers, as integral components of this standard, come in various forms, each with its own unique purpose. These identifiers encompass everything from globally unique message IDs, payment instruction identifiers, and transaction-specific codes to references for remittance information and local instruments.

For an in-depth exploration of ISO 20022, we invite you to delve into our comprehensive introduction featured in the following article.

Let's explore two fundamental concepts in financial transactions: point-to-point and end-to-end identifiers. Think of them as labels on a journey. Point-to-point identifiers are like tags specific to certain stops, while end-to-end identifiers are like a unique tracking number that stays the same throughout the entire trip. These concepts simplify data flow, ensuring financial information reaches its destination accurately and securely.

Point-to-point data is essential in payment messaging, pertaining exclusively to a specific payment stage. For instance, in a multi-bank cross-border payment, details like intermediary bank information and fees are considered point-to-point data, vital for that specific stage but not needed in later messages.

Conversely, end-to-end data exchange entails information that must traverse the entire payment chain unaltered. This data maintains its integrity from initiation through to its final destination, ensuring a seamless and coherent transaction process.

End-to-end data is vital in payment messaging, maintaining its significance across the entire transaction journey. For instance, a unique transaction reference code serves as end-to-end data, ensuring consistency and reliability from initiation to the payment's final destination, regardless of how many stages it passes through. It remains constant and unmodified as the payment moves from originator to beneficiary, offering a consistent reference point for all stakeholders involved.

In the diagram above, we present an illustrative example of a correspondent banking payment execution, showcasing a chain of three interconnected banks. Here are some key points to take note of regarding the preceding diagram:

Bank B generate their own point to point identifications

Bank C does not know point to point identifications of Bank A.

Intermediary parties like Bank B do not generate end to end references.

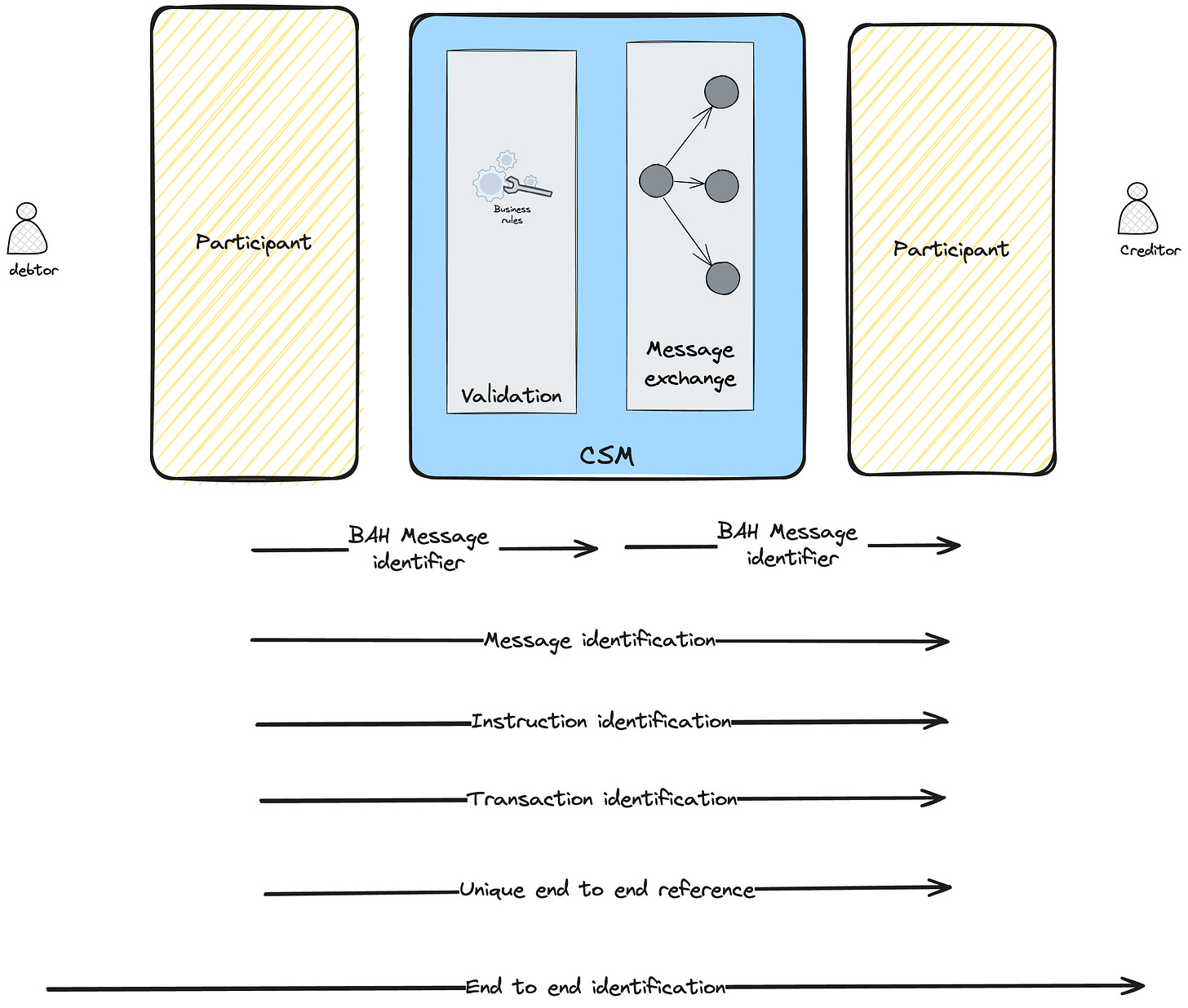

The following diagram offers a detailed view of the identifiers integrated into a credit transfer under ISO 20022.

To delve deeper into the Business Application Header, we invite you to explore our earlier post dedicated to this topic.

Message Identification (MsgId)

Message identification is the reference that CSM will check for uniqueness during the business day. A Message Identification (MsgId) is a globally unique identifier assigned to a specific message. It uniquely identifies the entire message, which may contain one or more payment instructions. It applies to the entire message, encompassing all the payment instructions it contains. In a batch of multiple payment instructions within a single message, the MsgId identifies the entire message itself.

Instruction Identification (InstrId)

An Instruction Identification (InstrId) is an identifier assigned to a specific payment instruction within a message. It helps distinguish and manage individual payment instructions within the message. In a message with multiple payment instructions, each payment instruction would have its own InstrId to uniquely identify it.

Transaction Identification (TxId)

A Transaction Identification (TxId) is an identifier assigned to an individual financial transaction. It is used to uniquely identify each transaction, whether it's a payment, trade, or another financial operation. It applies to a single transaction, which may or may not be part of a larger payment instruction or message. In a payment instruction to transfer funds to multiple beneficiaries, each beneficiary's transaction within that instruction would have its own TxId.

Unique End-to-End Reference (UETR)

This is a tracking reference that allows to track where the payment is. It is becoming a standard for cross border payments. You can use the transaction identification or the UETR. ISO requires either transaction identification or UETR which is an end to end reference in the interbank space. In ISO 20022 messages, the "Unique End-to-End Reference" (UETR) is a key field that can be used to trace and link the entire transaction from the initiating party to the final recipient. The UETR is designed to be globally unique and remains unchanged throughout the entire lifecycle of the transaction, ensuring that it can be tracked and reconciled accurately.

The UETR plays a crucial role in enhancing transparency, traceability, and security in financial transactions, making it easier to identify, monitor, and resolve issues or discrepancies that may arise during the transaction process. It is an important element of SWIFT gpi as we discussed in our SWIFT Overview article.

End-to-End Identification (ETEI)

Reference that the debtor wants to communicate all the way to the creditor. It serves as a unique end-to-end identification traveling between parties, primarily pertinent to customers, rather than financial institutions. Unlike references that financial institutions use for their internal processes, this identifier is customer-centric therefore this is not a reference of interest for the financial institution. End to end between the customers.